Global Central Banks Are Selling Gold, Should You Sell It Too?

Listen to Global Central Banks Are Selling Gold, Should You Sell It Too?

00:00

00:00

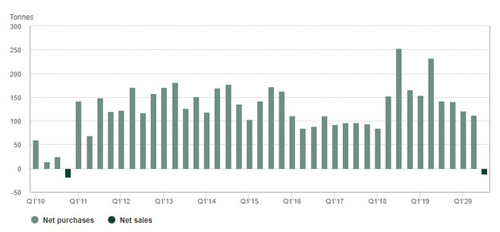

After being net buyers since the beginning of 2011, global central banks turned net sellers in Q3 2020, reducing global gold reserves by 12.1 tonnes (t), according to data from the World Gold Council (WGC). The jump in sales of 78.9t during the quarter can be attributed mainly to two central banks - Turkey and Uzbekistan.

Turkey reduced gold reserves by 22.3t during the quarter, the first quarterly decline since Q4 2018. According to the WGC report, Turkey witnessed rise in domestic gold demand in August and September which led to heightened gold trading activity between commercial banks and the central bank, resulting in this decline. However, on a y-t-d basis, the country remains the biggest gold buyer, adding 148.7t.

On the other hand, Uzbekistan reduced its gold reserves by 34.9t during Q3, bringing y-t-d net sales to 28.6t. The country is looking to utilise its gold reserves, capitalising on higher prices to mitigate the economic impact of the pandemic.

Tajikistan (9.2t), Philippines (7.8t), Mongolia (2.4t), and Russia (1.2t) were the other notable sellers during the quarter.

Graph 1: Central banks turned net sellers in Q3 after over a decade

(Source: World Gold Council)

(Source: World Gold Council)

Should you too sell gold?

There is a possibility that various central banks will look to sell their gold reserves to combat the impact of pandemic. However, WGC expects central banks to remain net buyers of gold in 2020, though at a slower pace than the previous two years.

The International Monetary Fund (IMF) has projected a contraction of 4.9% on global growth in 2020, with high levels of unemployment and wealth destruction due to the devastating impact of the COVID-19 pandemic. The economic recovery is expected to be slow due to the possibility of recurring waves of infection.

Thus, investors need to brace for a long-lasting impact on their portfolio performance amid the uncertainty caused by the pandemic.

Amid such uncertainty, gold has acted as a valuable asset from diversification and hedge point of view, not just for investors, but also for central banks.Notably, countries like India, UAE, Qatar, Kyrgyz Republic, Kazakhstan, and Cambodia were those that increased gold reserves by more than 1t.

Gold will continue to play an increasingly relevant role in the investor's portfolio, because in response to the pandemic when central banks around the world aggressively cut rates and/or expand asset purchasing programmes, the unintended consequences are:

-

Soaring equity market valuations that are not always backed by fundamentals, increasing the chance of pullbacks

-

Corporate bond price increases, pushing investors further down the credit-quality curve

-

Short-term and high-quality bonds have limited - if any - upside, reducing their effectiveness as hedges

Has the rally in gold prices run out of fuel?

After posting around 30% return on year-to-date basis, gold prices have plateaued over the past few weeks, down by over Rs 5,500 (per 10 gram) from its all-time high. Rally in US dollar on improved macro data and profit booking in gold has kept prices in check. However, uncertainties in the global economy such as those mentioned below means that gold would continue to shine.

-

Resurgence in virus outbreak in USA and Europe

-

A virus-led global recession looks inevitable

-

Muted consumption growth

-

Geopolitical tensions

-

Potential risk to the inflation trajectory (mainly on account of food)

-

The US Presidential elections in November 2020

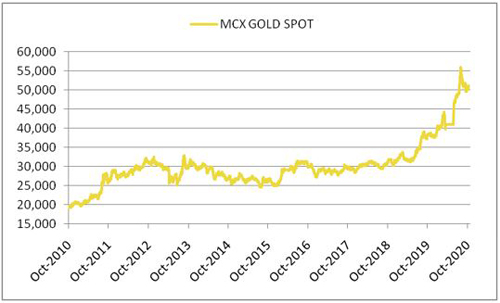

Graph 2: Gold displays its lustre in the long run

Data as on October 05, 2020

Data as on October 05, 2020

(Source: MCX, PersonalFN Research)

Going forward, gold is expected to display its lustre, play the role of an effective portfolio diversifier, a hedge (when other asset classes fail to post alluring returns), a safe haven, and command a store of value ---particularly when the world is staring at economic uncertainty induced by the pandemic and geopolitical tensions are escalating.

Therefore, it makes sense to tactically invest in gold. Irrespective of your risk profile, consider allocating around 10% to 15% of your entire investment portfolio in gold with a long-term view (whereby short-term price fluctuations can be mitigated).

Here are the smart ways to invest in gold:

-

Gold Exchange Traded Funds (Gold ETFs) - Gold ETFs are open-ended exchange-traded funds (offered by mutual funds) which track the price of gold, and each unit represents ownership of the gold asset. Each unit in the gold ETF is equal to 1 gram of gold (some mutual fund houses also offer 1 unit at 0.5 gram of gold).

The investment objective is to generate returns broadly in line with the performance of gold (the domestic price of gold).

You can purchase units of gold ETF on the recognised stock exchange; a demat account and share trading account is necessary.

Do note that on the exchange, the units can be purchased/sold in a minimum lot of 1 unit and multiples thereof. When you buy gold ETF, you get a contract indicating your ownership in gold equivalent to the rupee amount of your investment.

The gold is held on your behalf by an appointed custodian for the ETF. Notably, you will not get to see or receive delivery of the gold you own.

The tax implications when you sell physical gold and Gold ETFs are the same. Selling gold ETF units attracts capital gain tax. And in times of need, the units can be used as collaterals for loans.

-

Gold Saving Funds - This is an open-ended Fund of Fund scheme (offered by mutual fund houses) investing its corpus into an underlying Gold ETF, which benchmarks the performance against prices of physical gold.

Thus, the investment objective is to generate returns that closely correspond to returns generated by the underlying Gold ETF.

The application for purchase needs to be made to the respective mutual fund house, a demat account is not necessary. The units allotted reflect in your mutual fund account statement. The units are purchased/sold at the NAV declared by the mutual fund house.

Investment in a Gold Savings Fund can be done lump sum or through SIP (Systematic Investment Plan), whichever way is convenient for you.

The minimum investment amount to invest in a Gold Savings Fund is Rs 5,000; for additional purchase, the minimum amount usually is Rs 100; while the minimum SIP amount required is Rs 1,000 (with minimum 36 instalments).

Speaking of the tax treatment, in case of Gold Savings Fund and gold ETF is the same. Selling units of a Gold Savings Fund attracts capital gain tax.

To invest in gold regularly, systematically and in a disciplined manner, taking the SIP route with a Gold Savings Fund would prove sensible -- as it can help compound wealth with the benefit of rupee-cost averaging.

If you invest in gold now, it would probably help your investment portfolio overcome challenges caused by risk, volatility, and correlated global influences in the journey of wealth creation.

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds