Why It Is a Good Time to Invest In Mutual Funds Despite Market Recovery

Listen to Why It Is a Good Time to Invest In Mutual Funds Despite Market Recovery

00:00

00:00

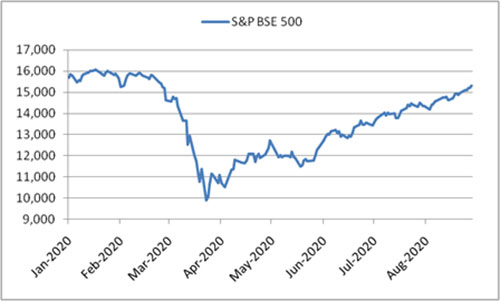

The swift recovery of the equity market post the COVID-induced crash has surprised savvy investors. Despite the fact that fresh cases of COVID-19 continue to surge and the economic outlook remains uncertain, the market is now inching close to its all-time high levels -- the S&P BSE 500 has rebounded around 55% from its lows of March. The market is most likely riding on the hopes of further normalization of economic activities and improvement in corporate earnings in the second half of the financial year.

Investors who held on to their investment have benefitted from the recovery. However, those who were pessimistic about any near term recovery in the market and withdrew their investments from mutual funds not only missed out on the rally, but in all likelihood converted their notional loss into an actual one. Now that the market is on its upward journey, a fear of missed opportunity looms.

So should you worry about missing the bus or is it still an opportune time to invest in mutual funds?

Graph: Equity market's swift recovery from the collapse

Data as on August 28, 2020

Data as on August 28, 2020

(Source: ACE MF)

Market rally has not been broad-based, but driven by few stocks across market capitalisation. Various stocks and sectors adversely affected by the pandemic have not recovered yet. These stocks sector may be poised to rally as economic activities normalize further and corporate earnings improve in the coming months.

Thus, fund managers still have opportunities to hunt for valuable stock/sectors even if valuations in few other stock/sector have become expensive.

Remember that the market can scale new highs even when it seems overvalued or correct further when it looks to have bottomed out, which makes timing the market a futile exercise. Mutual funds have the potential to generate higher returns than the market through the active management of the portfolio by fund managers. This makes it a potent tool for long-term wealth creation even though it may underperform in the short term.

Unlike stocks, there is no need to time the market when investing in mutual funds; which means, there is no good or bad time to start investing. The decision to buy/sell stocks at correct valuation is left to the expertise of the mutual funds manger at helm of the scheme.

Table: Mutual funds have the potential to perform well over the long term

| Category |

Absolute (%) |

CAGR (%) |

| 1 Year |

2 Years |

3 Years |

5 Years |

7 Years |

| Category average - Large & Mid Cap |

10.85 |

0.44 |

4.11 |

9.09 |

16.73 |

| Category average - Large Cap Fund |

6.94 |

0.84 |

4.99 |

8.30 |

14.15 |

| Category average - Mid Cap Fund |

18.21 |

1.14 |

4.21 |

8.55 |

19.93 |

| Category average - Multi Cap Fund |

9.43 |

0.83 |

4.73 |

8.47 |

15.91 |

| Category average - Small cap Fund |

20.72 |

-1.58 |

1.50 |

8.42 |

19.43 |

| Nifty LargeMidcap 250 Index - TRI |

12.07 |

-0.74 |

4.76 |

9.71 |

16.44 |

| NIFTY 50 - TRI |

6.50 |

0.79 |

6.83 |

9.15 |

12.77 |

| S&P BSE Mid-Cap - TRI |

15.27 |

-3.38 |

0.64 |

8.40 |

17.65 |

| S&P BSE 500 - TRI |

8.99 |

-0.43 |

5.00 |

9.05 |

14.06 |

| Nifty Smallcap 100 - TRI |

9.33 |

-11.13 |

-7.08 |

3.88 |

13.55 |

Data as on August 28, 2020

(Source: ACE MF)

As evident from the table above, returns from mutual funds have been higher than the market in most cases or largely in line with it. Thus, mutual funds can reward investors with superior returns over the long term regardless of whether they start investing during market lows or highs.

How to approach mutual funds now

The market path in the coming months will be guided by corporate earnings, demand revival, geopolitical stance, vaccine for the virus, etc. The road to economic recovery is expected to be a bumpy one, which could lead to further bouts of volatility and a likely correction.

To maximize returns in such a market environment, opt to stagger your investment over the next few months instead of committing a lumpsum amount. Even if the market starts correcting from here on, investing through the systematic investment plan (SIP) mode of mutual funds will help you accumulate more number of units at lower price.

Advisably, do not base your investment decision solely on the recent impressive performance of a mutual fund. This superior performance may or may not be sustainable in the future. Therefore, to choose a fund that performs consistently well, compare its performance to that of the relevant benchmark and the category peers over various market phases and cycles.

Ensure that you are investing with a goal in mind and stick with the investment plan until you achieve your goal. Since market movements are highly unpredictable, if you try to be overly adventurous or extra cautious during market highs/lows, it can prove to be counterproductive.

More importantly, investing in a diversified portfolio of mutual funds can efficiently tide over the market uncertainty and volatility; so invest in a strategic portfolio of mutual funds based on the 'Core & Satellite' approach to investing.

The 'Core' holding should comprise around 65-70% of your equity mutual fund portfolio and consist of large-cap fund, multi-cap fund, and a value style fund.

Whereas, the 'Satellite' holdings of the portfolio can be around 30-35% comprising of a mid-cap fund, a large & mid-cap fund, and an aggressive hybrid fund.

Additionally, to hedge your portfolio from adverse conditions such as the one we are witnessing now, allocate around 10% of your investment portfolio in gold, preferably through a Gold ETF or a Gold savings fund.

The 'Core & Satellite' approach aids in diversification across categories and investment styles, thereby reducing the risk to your portfolio. It can provide a cushioning during the downside in a bear phase and outperform the benchmark and category peers during a bull phase.

If your portfolio is strategically placed, there will be no need for constant churning of the portfolio and you will be well prepared to tide over short-term market volatility.

If you wish to invest in a readymade portfolio of top recommended equity mutual funds based on the 'Core & Satellite' approach to investing, I recommend that you subscribe to PersonalFN's Premium Report, "The Strategic Funds Portfolio For 2025 (2020 Edition)".

This premium report will help you build your optimum mutual funds portfolio for 2025 without any effort on your part. If you haven't subscribed yet, do it now!

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds