Should Retail Investors Stay Away From Debt Mutual Funds Altogether?

Listen to Should Retail Investors Stay Away From Debt Mutual Funds Altogether?

00:00

00:00

In the current times, debt mutual funds are proving to be theoretically right but practically imprudent. Whenever they lose investors' money, mutual fund houses take refuge under the standard disclaimer: Mutual Fund Investments are subject to market risks, read all scheme related document carefully.

Plus, debt mutual funds are often misleadingly presented to investors as low-risk investment products, when actually they aren't.

In the recent fiasco of Franklin Templeton Mutual Fund wherein six debt schemes were wound up, namely Franklin India Low Duration Fund; Franklin India Dynamic Accrual Fund; Franklin India Credit Risk Fund; Franklin India Short Term Income Plan; Franklin India Ultra Short Bond Fund; and Franklin India Income Opportunities Fund (handling investors' money worth Rs 26,000 crore ), citing COVID-19 dislocations; highlights the importance of approaching debt mutual funds very, very carefully. It will be quite a while before investor's in these schemes receive their hard-earned money back, and in a likely case would be returned after accounting for a loss.

[Read: Franklin Templeton Fiasco: Here Is When You Can Expect to Get the Money Back]

[Also read: Who is to Blame for the Franklin Templeton Fiasco?]

And it's not just Franklin Templeton Mutual Fund; there are other fund houses as well that chase higher yields and compromise on the quality of debt papers to clock high returns.

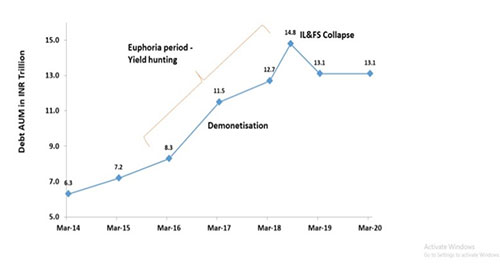

Graph: Hunt for yields brought you, the investor, to Debt Mutual Funds

(Source: Equitymaster's Emergency Web-Summit with Ajit Dayal)

(Source: Equitymaster's Emergency Web-Summit with Ajit Dayal)

My colleague, Divya, recently wrote to you how the Net Asset Values (NAVs) of certain schemes of HSBC Mutual Fund and Principal Mutual Fund plunged (eroded investor's wealth) and had a bearing on the AUM of respective debt schemes after they decided to write off their exposure to DHFL. Click here to read the article

Similarly, if you recall, when DSP Mutual Fund sold DHFL NCDs in 2018, the NCDs witnessed a huge 20%-25% fall. That time, they were "AAA" rated NCDs.

Fund managers of many of debt mutual funds were busy pleasing institutional investors-who more often than not-expected higher returns than money in the bank. The risk profile of debt funds is chiefly decided by the expectations of big institutional investors in the scheme.

Many mutual fund houses had started to view themselves as banks and gave a lifeline to troubled companies viz., IL&FS, Essel, Reliance ADAG, Jet Airways, DHFL, and not-so-credible real estate developers. In the hunt for higher yields, eventually certain debt papers turned toxic, hazardous, and investors lost their hard-earned money. The price for irrational exuberance had to be paid.

I'm not saying that all fund houses indulge in such practices, however looking at massive dislocations in this space, I think certain mutual funds have lost their credibility as far as the debt funds category is concerned.

Image source: pixabay.com; photo created by Oleg Gamulinskiy

Image source: pixabay.com; photo created by Oleg Gamulinskiy

These are just a few instances that point out: Debt Funds can actually be Death Funds! These expose you to high investment risk if you do not select the scheme sensibly.

Keep in mind, credit risk has amplified (due to slowdown in business) amidst the COVID-19 lockdown imposed to contain the spread of the deadly pathogen.

Since April 1 2020, there have been around 11 downgrades according to a review by India's four main credit agencies: CARE Ratings, Crisil, ICRA, and India Ratings & Research. Ratings of 774 domestic firms have been downgraded during this period and the current quarter could be the worst.

It is possible that debt papers which command 'AAA' rating today may be downgraded in time to come causing a credit risk contagion across the Indian mutual fund industry. And if this does transpire, in terms of value and the frequency at which debt funds may lose investors' hard-earned money may be unnerving.

Along with the interest rate risk, debt funds will expose you to high credit risk and liquidity risk.

So, should you avoid debt funds altogether?

Only funds that own a minimum of 80% in Government of India or PSU debt papers may be considered. For example, Banking & PSU Debt Funds that hold 85 to 90% of its assets in instruments issued by major Banks and PSUs. Likewise, a Dynamic Bond Fund, which invests only in government securities and a few selected PSUs.

To select a scheme, essentially assess your risk appetite and investment time horizon, plus factors such as:

-

✓ The portfolio characteristics of the debt schemes;

-

✓ The average maturity profile;

-

✓ The corpus & expense ratio of the scheme;

-

✓ The rolling returns;

-

✓ The risk ratios;

-

✓ The interest rate cycle; and

-

✓ The investment processes & systems at the fund house

In the current scenario -- where interest rates seem almost bottomed out -- you would do better going with a pure Liquid Funds and/or an Overnight Fund that does not have exposure to private issuers.

Our friends at Quantum Mutual Fund have highlighted the secret behind their debt management strategy, which has helped them provide safety and liquidity to investors when it comes to investing in Quantum funds. Don't Worry, Quantum Liquid Fund always aims for Safety and Liquidity.

You may consider funds like Quantum Liquid Fund, Parag Parikh Liquid Fund, in the liquid fund category with an investment time horizon of less than 1 year, and/or SBI Overnight Fund. These are schemes from fund houses that follow a robust investment process and systems.

Looking at the widespread contagion of credit risk and mismanagement of fund houses, I believe the aforesaid sub-categories of debt funds would be befitting for the safety of principal over returns. It is time to distance yourself from other debt funds - particularly those holding a predominant portion in debt papers issued by private issuers and low-rated instruments in the hunt for higher yield.

Remember, investing in debt funds is not risk-free.

Alternatively, if you prefer to keep your capital safe, opt for bank fixed deposits.

Happy Investing!

Warm Regards,

Rounaq Neroy

Editor, Daily Wealth Letter

PS: If you wish to select worthy mutual fund schemes, I recommend you to subscribe to PersonalFN's unbiased premium research service, FundSelect.

Additionally, as a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

Each fund recommended under FundSelect goes through our stringent process, where they are tested on both quantitative as well as qualitative parameters.

Every month, PersonalFN's FundSelect service will provide you with insightful and practical guidance on equity mutual funds and debt schemes - the ones to Buy, Hold, or Sell.

If you are serious about investing in a rewarding mutual fund scheme, Subscribe now!

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds