Should You Stop SIPs Amid Coronavirus Outbreak and Market Fall?

Listen to Should You Stop SIPs Amid Coronavirus Outbreak and Market Fall?

00:00

00:00

You might recall the story of my neighbor Mr Shetty who could not proceed with a mutual fund transaction because he was not a KYC-verified investor. After I informed him on the importance of KYC verification and the steps to complete, he quickly got his KYC obligation completed.

Yesterday, I received a frantic call from him when the S&P BSE Sensex fell close to 4,000 points in a day, its worst fall ever, "I know that markets are prone to ups and downs... but this is sheer madness. I am worried that the market mayhem will endanger my financial goals.

I calmly responded, "The market crash is the result of the fast spreading coronavirus and its likely negative impact on the world economy. The fall is in line with the global benchmark indices as the domestic market usually tracks the major global indices and is likely to continue to be highly volatile in the near future."

"Tell me what to do. Should I stop my SIPs?", he said.

I said that stopping SIPs now will be a big blunder, "Your children are still very young and it will be a long while before you need the money that you are saving for their future and your retirement, so why worry about poor returns in the short term?"

I further explained to him the importance of continuing SIP during tough market conditions.

You, dear readers, should know it too.

A famous quote by Benjamin Graham, known as the father of value investing, says 'Successful investing is about managing risk, not avoiding it'.

If you stop SIP now or worse redeem your investment, you will lose out majorly from the market recovery. In fact, it is a good opportunity to top up your equity exposure through SIP based on your risk appetite and financial goals.

Markets across large, mid, and small caps have corrected sharply from their peaks. So when you invest through SIPs now, you will be able to accumulate more number of units for the same investment value.

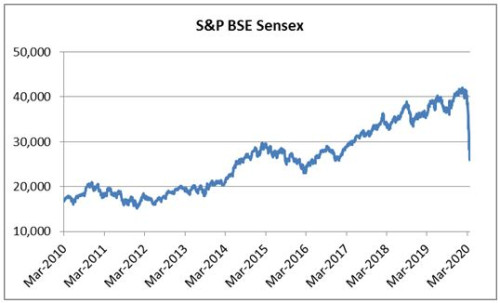

Graph: Sensex's steep rise over the years hits a roadblock

Data as on March 23, 2020

Data as on March 23, 2020

(Source: ACE MF)

The higher number of units accumulated through SIPs during market downturn will most likely rise sharply in value when the problems subside and average out your overall investment.

The government will likely provide the stimulus to sectors most affected by the coronavirus spread. Moreover, RBI has maintained that it will take necessary actions to provide stability to the market. This could aid in the recovery of the market when the issue is resolved.

Moreover, the coronavirus pandemic which hopefully is an once-in-a-lifetime event has made valuations across market capitalisation attractive from investment perspective.

History suggests that the market stages a smart recovery after every deep slump. A similar crash was witnessed during the global financial crisis of 2008. The equity market has grown multifold since then and has rewarded long term investors handsomely for their patience. Therefore, you must hold on to your investment during this difficult phase.

At the same time, it is important to choose the right funds to SIP into... It would be unwise to have false hopes of recovery from funds that lack fundamentals -- they may not bounce back with handsome gains.

[Read: Selecting Mutual Funds Carelessly Can Cost You Dear]

What you need for your portfolio are worthy funds that fall lower than the benchmark and category peers during weak market conditions and bounce back higher during the recovery phase. The schemes that you choose for SIP can make a lot of difference to the overall portfolio gains.

Furthermore, due to the uncertainty and volatile nature of economy and market conditions, it would be best to diversify your investment across categories and investment styles. But avoid risky bets like small cap funds and sectoral/thematic funds if you don't have the appetite for high risk.

Table: Top performing schemes outpace index with substantial margin

| Category |

XIRR (%) |

| 6-month |

1-year |

3-year |

5-year |

10-year |

| Large Cap Funds |

|

|

|

|

|

| Best performing fund |

0.09 |

9.13 |

11.99 |

12.88 |

13.54 |

| Worst performing fund |

-32.26 |

-18.78 |

-2.43 |

2.33 |

6.25 |

| Category Average |

-14.91 |

-3.36 |

2.80 |

6.17 |

9.63 |

| S&P BSE Sensex - TRI |

-17.40 |

-4.54 |

6.10 |

9.17 |

10.43 |

| Mid cap Funds |

|

|

|

|

|

| Best performing fund |

27.95 |

17.29 |

11.62 |

12.28 |

15.50 |

| Worst performing fund |

-19.86 |

-9.10 |

-5.15 |

1.29 |

5.93 |

| Category Average |

8.14 |

8.37 |

2.00 |

6.07 |

12.87 |

| S&P BSE Midcap - TRI |

-5.61 |

-0.28 |

-2.48 |

4.12 |

10.43 |

| Small Cap Fund |

|

|

|

|

|

| Best performing fund |

49.85 |

29.82 |

14.73 |

14.00 |

19.78 |

| Worst performing fund |

-18.58 |

-15.30 |

-11.96 |

-5.24 |

1.39 |

| Category Average |

8.77 |

4.67 |

-3.05 |

3.11 |

11.93 |

| S&P BSE Smallcap - TRI |

0.20 |

-1.24 |

-6.64 |

1.06 |

7.90 |

| Multicap Fund |

|

|

|

|

|

| Best performing fund |

9.69 |

12.90 |

9.10 |

10.83 |

13.87 |

| Worst performing fund |

-30.88 |

-18.00 |

-12.95 |

-12.95 |

-12.95 |

| Category Average |

-9.68 |

-0.59 |

1.59 |

5.41 |

9.83 |

| S&P BSE 500 - TRI |

-17.70 |

-6.28 |

1.32 |

6.41 |

9.85 |

| Large & Mid Cap Funds |

|

|

|

|

|

| Best performing fund |

13.70 |

11.26 |

6.73 |

12.08 |

19.96 |

| Worst performing fund |

-22.37 |

-12.11 |

-4.77 |

0.91 |

4.66 |

| Category Average |

-5.74 |

1.87 |

2.36 |

6.53 |

11.39 |

| S&P BSE LargeMidcap - TRI |

-19.93 |

-7.25 |

2.01 |

6.74 |

9.88 |

| Focused Funds |

|

|

|

|

|

| Best performing fund |

13.23 |

17.91 |

13.13 |

13.10 |

15.38 |

| Worst performing fund |

-35.00 |

-19.18 |

-7.31 |

-0.26 |

6.17 |

| Category Average |

-10.55 |

-0.43 |

3.07 |

6.99 |

10.59 |

| S&P BSE Sensex - TRI |

-17.40 |

-4.54 |

6.10 |

9.17 |

10.43 |

| Value/Contra Funds |

|

|

|

|

|

| Best performing fund |

-1.76 |

2.58 |

4.51 |

8.88 |

13.72 |

| Worst performing fund |

-31.02 |

-21.92 |

-15.14 |

-4.68 |

5.73 |

| Category Average |

-18.11 |

-9.18 |

-3.47 |

2.84 |

9.90 |

| S&P BSE 500 - TRI |

-17.70 |

-6.28 |

1.32 |

6.41 |

9.85 |

Data as on March 20, 2020

(Source: ACE MF, PersonalFN Research)

You can opt for the 'Core & Satellite' approach for optimum diversification and invest via the SIP mode in a staggered manner to reduce the overall impact of volatility.

Besides, if you have investible surplus, it makes sense to invest some portion through lump sum as the markets have corrected severely. But do so only if your risk appetite allows it and if you have a long term horizon.

The 'Core' part consists of the more stable, long-term holdings of the portfolio consisting of large-cap fund, multi-cap fund, and value style fund. Whereas, the 'Satellite' part consisting of mid-cap fund, large & mid-cap fund, and an aggressive hybrid fund can help push up the overall returns of the portfolio.

Through this approach your portfolio will be not only be well placed to outperform during the market recovery, but also be able to contain the downside if the volatility persists.

If you wish to invest in a readymade portfolio of top recommended equity mutual funds based on the 'Core & Satellite' approach to investing, I recommend that you subscribe to PersonalFN's Premium Report, "The Strategic Funds Portfolio For 2025 (2020 Edition)".

This premium report will help you build your optimum mutual funds portfolio for 2025 without any effort on your part. If you haven't subscribed yet, do it now!

Thankfully, investors have shown faith in the SIP mode of mutual funds -- contributions to SIPs have been quite robust until February 2020 and may continue to rise steadily in the future.

Mr Shetty thanked me for saving him from committing the huge mistake of discontinuing SIP because he understood that just like in real life, in the equity markets too, 'Everything will be okay in the end. If it's not okay, it's not the end.'

Warm Regards,

Divya Grover

Research Analyst