| S&P BSE Sensex* |

Re/US $ |

Gold Rs/10g |

Crude ($/barrel) |

FD Rates (1-Yr) |

35,511.58 |919.19

2.66% |

63.88 |-0.19

-0.30% |

29,905.00 | 908.00

3.13% |

69.15 |-0.11

-0.16% |

5.0% - 6.75% |

Weekly changes as on January 11, 2018

BSE Sensex value as on January 12, 2018

Impact

On account of falling inflation and declining interest rates, debt fund investors in India earned attractive returns between 2013 and 2017. As these factors are now turning unfavourable, the celebratory mood seems to be dimming. How should you approach fixed income investments in 2018? That’s what we’re discussing here…

So, what decides the fate of investors investing in debt funds and fixed deposits?

Primarily, the movement of interest rates in the economy When the interest rates drop lower, debt fund investors tend to make more money. Hence, bond prices and interest rates are inversely related.

However, this doesn’t mean falling interest rate put fixed deposits at a disadvantage.

Falling interest rates may not erode your returns on fixed deposits if inflation is falling as well. Until recently, the interest rates were falling and so was the inflation rate.

But now the scenario has changed. Inflation is creeping up and interest rates offered on deposits are still going downhill.

In the absence of a higher credit off-take, the banks are discouraging fresh deposits. They are achieving this through two means-

- Slashing interest rates and

- Promoting mutual funds to boost their fee income.

Unless the demand for credit picks up and the banking system (which is witnessing a rise in liquidity post demonetisation) feels the cash crunch, the interest rates on fixed deposits may remain low.

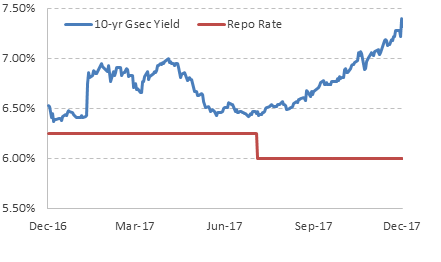

The 10-year benchmark has yield hardened

Data as on December 31, 2017

(Source: RBI, PersonalFN Research)

Factors to watch out for in 2018

- The Federal Reserve (Fed) seems to be determined to hike rates at least thrice in 2018. In turn, this will make emerging market bonds unattractive at current yields, unless the risk profile of a country significantly improves. While ratings upgrade by Moody’s might help India to some extent, it won’t be good enough to avert the global trend of rising bond yields.

- The decline in farm-produce output may become a matter of concern, if the agriculture sector fails to revive in the Financial Year (FY) 2018-19. This poses a risk of higher food inflation.

- The stability of the Indian Rupee is crucial for bond yields to remain stable. If the Indian currency depreciates sharply, Indian bonds may become unattractive at the current yields.

- Moreover, the debt markets would closely track the government’s approach to fiscal deficit. If the government goes on a spending spree, bond markets may react negatively.

Given the factors at play, now it looks like the RBI will maintain its neutral stance on policy for a while— i.e. it will neither favour accommodative nor the tight monetary policy.

During such times, selecting the category of debt mutual funds first becomes crucial.

PersonalFN is of the view that, investing aggressively at the longer end of the yield curve could prove imprudent. To put it simply, investing in long-term debt fund (holding longer maturity debt papers) can be perilous, since most of the rally has been already captured at the longer end of the yield curve.

In fact, short-term maturity papers are turning attractive and fund houses are aligning their portfolio accordingly too.

Ideally, you’ll be better-off if you deployed your hard-earned money to short-term debt funds. But ensure you’re giving due importance to your investment time horizon, asset allocation, and diversification. Consider investing in short-term debt funds for an investment horizon of upto two years.

If you have an investment horizon of 3 to 6 months, ultra-short term funds (also known as liquid plus funds) would be the most suitable.

And if you have an extreme short-term time horizon (of less than 3 months), you would be better-off investing in liquid funds.

Don’t forget that investing in debt funds is not risk-free. Therefore consider the 5-facets while investing in debt funds.

Some other options to invest in debt instruments are tax-free bonds, especially, if you are in the highest tax-bracket.

A few highly rated corporate deposits and bonds may also yield better returns than bank FDs. Ensure you study the company’s financials before investing, as the risk of default can’t be ignored. This will buffer you from any financial shock.

Sensible and astute investment strategy serves the path to wealth creation and it’s always beneficial for your long-term financial wellbeing.

Who Contributes The Most To Equity Mutual Funds’ AUM, Know Here…

Impact

Improved market sentiment and the falling interest rates have contributed to the good run mutual funds have had over the last few years.

Assets Under Management (AUM) of the mutual fund industry jumped over 32% in the last one year. Since gold and real estate generated average returns over the past few years, equity markets have suddenly become hot property.

Demonetisation and GST played their role in the growing share of financial assets in the average household savings.

The mutual fund industry is witnessing continuous inflows through Systematic Investment Plans (SIPs) like never before. This is no more a secret.

Investment awareness campaign—Mutual Funds Sahi Hai—run by the Association of Mutual Funds in India (AMFI) is yielding results. Besides, the reasons mentioned above, Sahi Hai has pushed investors towards equity investments.

To read more about this story and Personal FN’s views, please click here.

Should Tax Deduction On Pension Funds Matter To Plan Your Retirement? Know Here…

Impact

We are hopeful that the government would allow a pension plan. This will help us to offer a long-term retirement plan."

These are comments from a senior mutual fund official about the industry’s expectations on the taxation issues pertaining to pension plans.

The mutual fund industry has been lobbying the government to offer exclusive tax deductions to pension plans, but their efforts have been futile.

The working population is becoming increasingly cautious about retirement savings. And, mutual fund houses see an immense opportunity for expansion in this instrument/avenue.

At present, insurance companies dominate the pension plan sector in India. According to a report presented by Ernst & Young, premiums collected under pension plans account for nearly 1/4th of the insurance companies’ total collections.

What these companies often do is blend a vanilla savings scheme with an insurance component and sell this as a product. They promote it as being designed to suit the specific requirements of investors.

To read more about this story and Personal FN’s views, please click here.

Your Tax-Free Gratuity Limit To Increase. Read This!

Impact

India has a weak, practically non-existent social-security framework. You would be astonished to know, the formal sector accounts for 30% of urban jobs and about 25% of the non-agriculture rural jobs. It means a majority of the workforce isn’t covered under the benefit programmes applicable to this sector.

While the situation may change over time, those already working in the organised sector are likely to benefit soon.

The government seems serious about offering more social security to the organised-sector workforce. Recently, it tabled the Payment of Gratuity (Amendment) Bill, 2017 in the Parliament. The Bill endeavours to amend the Payment of Gratuity Act, 1972.

To read more about this story and Personal FN’s views, please click here.

Why Mutual Fund Investors Should Tone Down Their Return Expectations

Impact

When the market is at record highs, returns over multiple periods look extraordinary.

The 1-year, 3-year and 5-year returns of the S&P BSE 200 index as on January 12, 2018 works out to 31%, 12%, and 14% respectively.

The top mutual funds delivered returns in excess of 40%-50% in the 1-year periods. Over 15%-20% compounded in the 3-year periods and above 20% compounded in the 5-year periods.

Looks impressive, but can you expect the same kind of returns from mutual funds over the next 1-year, 3-year and 5-years?

Many nascent investors expect to achieve this kind of returns in just three to five years. If you are expecting to achieve double-digit returns from mutual funds within this time-frame, you may be in for a rude shock.

What most investors overlook and what most advisors fail to highlight, in layman terms, is the probability of scoring mediocre returns or suffering even a loss of capital.

To read more, please click here.

FUND OF THE WEEK

HDFC TaxSaver: Is This Still A Top ELSS Fund?

HDFC TaxSaver is an open-ended equity linked savings scheme (ELSS), offered by HDFC Mutual Fund, with an objective of wealth creation in the long term. Like all ELSS funds, it has a lock-in period of three years. Launched in 1996 is one of the oldest fund in the ELSS category and has generated whopping 26.94% CAGR returns since its inception for its investors.

However, HDFC TaxSaver has trailed other peers when looking at its overall performance compared to other ELSS funds. Its passive fund management strategy helped in controlling its downside market risk. At times, HDFC TaxSaver has failed in taking advantage of opportunities available in the market at different times. Though the fund has outperformed its benchmark index Nifty 500 across several time frames it has failed to stay upbeat and compete with its peers in the ELSS category.

The Average Assets Under Management (AAUM) of HDFC TaxSaver has been steadily on the rise since March 2016. This is an outcome of the market rally witnessed since February 2016 and steady inflows from retail investors who have been flocking to equity investments over the past few years. As a result of this, HDFC TaxSaver has enjoyed a steady growth in assets.

To read more about this fund, please click here

And Other News...

To make goods and services more affordable to the common man, the government seems to have swallowed the bitter pill.

The GST Council (Goods And Services Tax Council) has lowered the tax rates on 29 goods and 53 services.

What happens with this is, everything from affordable housing to drinking water and a whole gamut of things will become cheaper from January 25, 2018.

With this, it has agreed to forgo the revenues Rs 1,000 crore to Rs 1,200.

The Council has also addressed some important issues pertaining to filing tax returns. This is positive news for manufacturers and consumers alike.

Tutorials…

6 Tasks To Complete When Parents Pass Away

All You Need To Know About Estate Planning

Financial Terms. Simplified.

Expansionary Policy: An expansionary policy is a macroeconomic policy that seeks to expand the money supply to encourage economic growth or combat inflationary price increases. One form of expansionary policy is fiscal policy, which comes in the form of tax cuts, transfer payments, rebates and increased government spending. Another form is monetary policy, which is enacted by central banks and comes about through open market operations, reserve requirements and interest rates.

(Source: Investopedia)

Quote: "A bank is a place that will lend you money if you can prove that you don't need it."‒Bob Hope