Mr Arjun Malhotra, a 30-year-old architect, holds investments in several mutual fund schemes across 5 AMCs. He independently researches and takes a call on where to invest in based on his current understanding or knowledge of the market.

But often he’s frustrated with the amount of paper/administrative work he has to encounter with every fresh investment. He has presented multiple cheques for multiple schemes, invested in multiple folios, and watching out for his mutual fund investments turns into a problem.

Can you relate to what Mr Arjun is going through? Have you faced this situation and end-up feeling frustrated?

Some of you may have given up halfway, hindering the path to creating wealth with investment portfolios vide mutual funds.

But, now there is a way out…

A mutual fund transaction portal, MFU (Mutual Fund Utilities) is a single window for you to transact across the mutual fund schemes using a Common Transaction Form (CTF). It is an investor-friendly platform that has eased the process of transacting in mutual funds —purchases (lump sum and SIP), redemptions, switch, STP (Systematic Transfer Plan), and SWP (Systematic Withdrawal Plans).…

All you have to do is first create your Common Account Number (CAN), which is a unique reference number issued by MFU.

Once this is complete, CAN will map itself with your existing mutual fund folios across fund houses (participating in MFU), thereby providing you with a consolidated view of all your mutual fund investments in India. This is because CAN is held centrally across the industry and includes details such as your name, mode of holding, nomination, KYC status, nationality, tax status, bank account details, depository account details, guardian’s information (in case of a minor), power of attorney (if any), and so on.

So, it saves that hassles of filling the account opening form each time you invest in a mutual fund scheme.

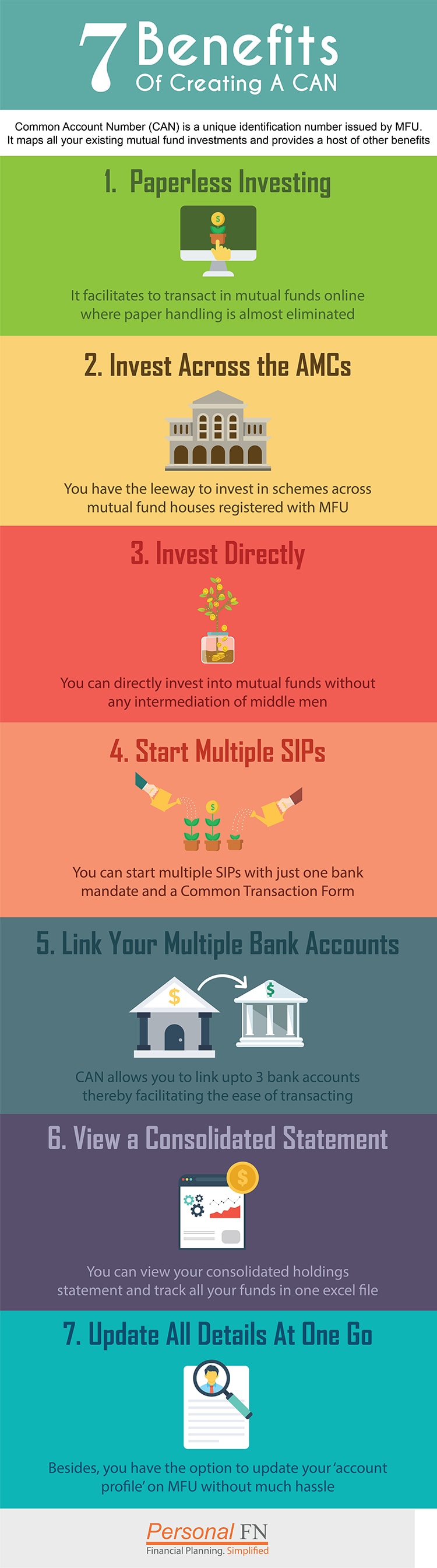

Here are some of the benefits of creating a CAN…

- Paperless Investing:

CAN facilitates you to transact in mutual funds online with ease. Paper handling is almost eliminated. Once the KYC procedure is completed with MFU, you can transact online vide CTF, and even route your transactions online through various modes.

- Invest Across the AMCs:

You have the leeway to invest in mutual fund schemes across mutual fund houses. But ensure you aren’t creating new folios, if you’re already holding units within a respective fund house (unless you have specific objective in mind). This will help you keep a better track of mutual fund investments.

Remember not to confuse your CAN with your folio numbers.

CAN is the unique identification number generated by MFU; while folios are generated by mutual fund houses for their investors.

- Invest Directly:

With the help of CAN, you can invest directly sans intermediation of mutual fund distributor agent / investment adviser / relationship manager, who often put to their interest before yours. When you invest, opt for ‘direct plans’ over regular plans; because over the long-term ‘direct plans’ can add significant wealth over the long-term, which can help you accomplish vital financial goals of life.

- Start Multiple SIPs:

To plan for vital financial goals such as buying a dream home, a car, child’s education, their marriage needs, your retirement, among a host of others; you can start multiple SIPs with just one bank mandate and using the CTF. This adds convenience when investing to accomplish financial goals.

- Link Your Multiple Bank Accounts:

CAN allows you to link multiple bank accounts. In other words, if you have more than one bank account, you have the flexibility of paying or redeeming your money from these accounts.

- Track All Your Investments Through One Platform / View a Consolidated Statement:

You can now track all your funds at one go. You do not have to keep a track of all your mutual funds’ NAV in an excel file. With CAN, just download your consolidated holdings onto an excel sheet at any given point of time, allowing you to do further analysis.

So, it does away with the current practice of downloading the account statement either from individual AMC or registrar website.

This facilitates quicker and better investment decision making. It also enables you to keep a close track of your mutual fund investments, and when need be, review your mutual fund portfolio.

- Update Your Details at One Place

Besides, if over the years any of your personal details such as contact details, bank details, etc. have undergone a change, you have the option to update your ‘account profile’ on MFU without much hassle.

To sum-up…

The MFU platform offers ease, convenience, and speed of transacting in various mutual fund schemes. It does away with the anxiety of knowing whether your mutual fund distributor / agent / investment adviser / relationship manager has submitted your transaction slip before the cut off time. You’re in better control of your investment activity, and managing your mutual investments is trouble-free with online, quick and paperless investing.

So go ahead and make your CAN today!

If you need superlative and unbiased research-backed guidance to select the best equity mutual fund schemes for your portfolio,

opt for PersonalFN’s 'FundSelect' service. We will share with you 6 ultimate secrets to beating the market by a whopping 70%! It is the simplest and potentially the best way to grow your portfolio value significantly!

Add Comments