(Image source: freepik.com; photo credit: ijeab)

(Image source: freepik.com; photo credit: ijeab)

Toxic debt papers have impacted the financial wellbeing of debt mutual fund investors. After the IL&FS default episode, many others such as DHFL, Reliance Media Works, Reliance Infrastructure, Essel Group, Amtek Auto and Jindal Steel & Power Ltd (JSPL) were in news for financial distress and/or poor governance. The credit risk hasn't reduced; in fact, now it has amplified amidst the economic slowdown and turbulence in the capital market.

Recently, as reported by the press, after Yes Bank shares plunged due to family feud, corporate governance issues, poor compliance, and on asset quality concerns, Reliance Mutual Fund has asked the promoters of Yes Bank to top their collateral up by Rs 500 crore.

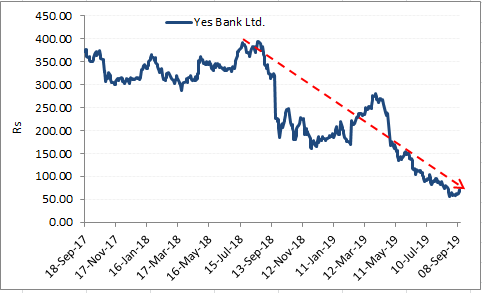

Graph 1: Tumultuous ride for Yes Bank investors...

Data as of September 13, 2019

Note: Price adjusted after stock split

(Source: NSE)

Rana Kapoor and his family-owned firm Morgan Credits Pvt. Ltd (MCPL), the promoters of Yes Bank, which hold 4.31% and 3.03% respectively, had pledged their total 7.34% stake with Reliance Nippon Life Asset Management Ltd (the asset manager of Reliance Mutual Fund) amounting to around Rs 1,500 crore.

The timing of the above development assumes significance, as speculations are rife that Mr Rana Kapoor plans to sell his unpledged 2.97% stake in Yes Bank and is in advance talks with Vishal Shekhar Sharma, the founder of Paytm.

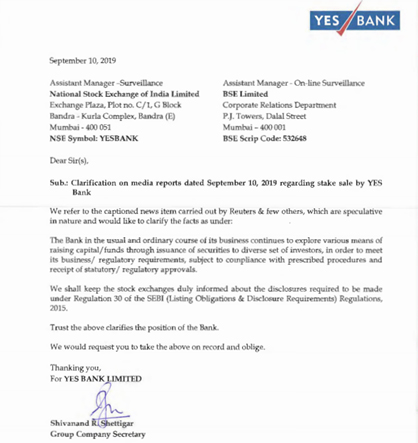

Although, as per certain media reports, while Mr Kapoor has the consent from Reliance Nippon Life Asset Management Ltd. do so and fetch over Rs 1,500 crore and pay the money owed, here's what Yes Bank stated and clarified in its stock exchange filing on September 10, 2019:

(Source: www.bseindia.com)

Reliance Mutual Fund had a remarkable exposure of Rs 2,177 crore as on July 31, 2019, to debt papers of Yes Bank debt papers, while the cumulative exposure of other mutual fund houses was Rs 1,242 crore.

The risk for Reliance Mutual Fund, in particular, is amplified after the SEBI's board decision (taken in June 2019) to make mandatory for "debt secured by shares" as the collateral to have a cover at least four times the debt issued. While the time frame for this has not been defined, it is expected that it will be brought into force soon.

Reliance Mutual Fund also has a good amount of exposure to toxic debt papers of Mumbai-based Altico Capital India Ltd as well, a Non-Banking Finance Company (NBFC) incorporated in January 2004 by the name of Clearwater Capital Partners India Private Ltd financing the real estate sector. Altico Capital has defaulted on interest payments worth Rs 19.9 crore due to Mashreq Bank, Dubai on September 12, 2019, on a principal amount of Rs 340 crore.

Here's what the Altico Capital India said...

"Our failure to repay the amounts set out above may result in an acceleration of interest repayment and redemption obligations in respect of non-convertible debt securities issued by us and may trigger a default in their timely repayments. We are evaluating options for resolving the liquidity crisis and will be engaging in discussions with various stakeholders for the same."

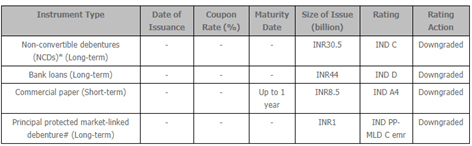

India Ratings and Research (Ind-Ra) has downgraded Altico Capital India's Long-Term Issuer Rating to 'IND D' from 'IND A+' and Short-Term Issuer Rating to 'IND D' from 'IND A1'. The rating agency has also assigned a 'Negative' outlook for both.

Table 1: How debt papers of Altico Capital India are rated?

(Source: India Ratings and Research Press Release)

The reasons for the downgrade cited by the rating agency are:

- Poor liquidity (which could pose difficulty to service its debt in a timely manner hereon);

- Asset quality challenges could potentially increase (mainly to real estate developers, many of who have weak and stretched credit profiles); and

- Concentrated loan book with high single party exposure

Apart from Reliance Mutual Fund, UTI Mutual Fund, and Kotak Mutual Fund also have exposure to Altico Capital India in the Fixed Maturity Plan (FMP), credit risk, medium duration, and ultra-short duration category schemes.

What should debt mutual fund investors do?

(Image source: pixabay.com; photo credits: geralt)

If you already have exposure to debt mutual fund schemes with toxic debt papers, if possible, do away with the ones that would prove perilous to your wealth after doing a systematic portfolio review.

It is important for you, as an investor, to approach debt mutual funds with caution and your eyes wide open. Do not assume debt mutual funds to be risk-free; they are not!

In search of returns, understand the credit risk involved. Not paying attention to the portfolio characteristic of a debt mutual fund scheme can result in making the wrong investment choices and will thus lead to wealth erosion.

[Read: Why Your Money In Liquid Funds Is At Risk]

Unfortunately, some debt fund managers have not taken calculated risk, been imprudent in their judgement, and taken exposure to heavily indebted business houses, which ultimately backfired on the overall performance of those mutual fund schemes.

Likewise, investment advisers, overzealous in promoting debt mutual funds and liquid funds as an alternative to fixed deposits have let their clients/investors down by recommending debt mutual fund schemes whose portfolio characteristic were compromised and failed to do a portfolio review.

That being said, credit risks can knock doors randomly and avoiding them is almost impossible-- even for a seasoned fund manager or an investment adviser. However, a process-driven approach, less dependence on concentrated exposures (for generating higher returns), and focus on portfolio characteristics can help reduce the risk involved when you choose a debt mutual fund scheme.

At PersonalFN, we follow a holistic process where we evaluate debt mutual fund schemes by paying attention to portfolio characteristic (quality of debt papers, maturity profile, yield-to-maturity, etc.), returns (across time frames, across interest rate cycles), risk ratios (Shape, Sortino, Standard Deviation), percentage of AUM actually performing, expense ratio, fund manager-to-scheme ratio, fund manager's experience, risk and transparency at the fund house, investment process & systems, among many others before recommending mutual fund schemes. Hence, our recommendations tend to do far better than the benchmark returns.

Editor's Note: If you wish to select the best mutual fund schemes-equity and debt mutual fund schemes --to address your future financial needs, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

Additionally, as a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

Each fund recommended under FundSelect goes through our stringent process where we assess each one on both quantitative as well as qualitative parameters.

Every month, PersonalFN's FundSelect service will provide you with insightful and practical guidance on equity mutual funds and debt mutual fund scheme -the ones to Buy, Hold, or Sell.

If you are serious about investing in rewarding mutual fund schemes, subscribe to PersonalFN's flagship mutual fund research service FundSelect today!

Happy Investing!

Add Comments