However, to comply with SEBI's diktat on mutual fund categorisation, HDFC MF needed to categorise them differently. Merging the schemes would have been an imprudent strategy, given that HDFC Balanced Fund has an AUM of Rs 21,000 crore and HDFC Prudence Fund a corpus of Rs 38,000 crore.

HDFC MF decided to categorise HDFC Prudence Fund as a Balanced Advantage Fund. The Fund will merge with HDFC Growth Fund and will be renamed HDFC Balanced Advantage Fund. This categorisation gives the fund house to dynamically manage the asset allocation of the fund to Equity and Debt securities.

Here's what will change for HDFC Balanced Fund:

As per SEBI's nomenclature, balanced funds (this was a misnomer in the first place) are now termed as Aggressive Hybrid Funds or better called by fund houses as Hybrid Equity Funds. Such funds need to invest a minimum of 65% in equity. HDFC MF proposes to categorise HDFC Balanced Fund under this category, after merging it with HDFC Premier Multi-Cap Fund. The new scheme will be known as HDFC Hybrid Equity Fund. The effective date for these changes is June 1, 2018

Hybrid Equity Funds have a mandate to invest a minimum of 65% and a maximum of 80% in equity. This asset allocation makes this category of funds similar to Balanced Funds of the past. Thus, investors of HDFC Balanced need not worry about the cosmetic changes of the scheme. However, they should take a closer look at how the scheme has performed in the past and its ability to deliver efficient risk-adjusted returns.

For the entire list of scheme names changes, do read: Your Mutual Fund Scheme Renamed. What Should You Do?

In terms of performance, HDFC Balanced fund has consistently outperformed the benchmark across market periods, while maintaining a tab on risk. The fund boasts of a stable fund management, with Mr Chirag Setalvad being at the helm for over a decade.

The longer-term returns of the fund are more encouraging. Over the longer periods of 3-years and 5-years, HDFC Balanced Fund has outpaced the Crisil Hybrid 35+65 Index by a decent margin with returns of 13.46% and 19.05% respectively. However, investors would be tad disappointed with the fund's recent performance over the past 1 year.

Could the recent underperformance of the fund be due to its burgeoning corpus? Over the past couple of years, the corpus of HDFC Balanced Fund has doubled in each year. The hybrid fund's corpus more than doubled to Rs 9,508 crore as in February 2017 from Rs 4,695 crore in February 2016. In the past year, the fund corpus again doubled to Rs 20,081 crore in January 2018. The fund's corpus now stands at Rs 21,700 crore, as on April 30, 2018.

As far as the AUM of mutual funds is concerned, PersonalFN is of the view that the size of a mutual fund schemes doesn't tell you anything about its future performance. The key to a fund's performance lies in its investment style, which is also a factor of the fund manager's experience and investment processes followed by the fund house.

It is best to assess whether the AUM growth is causing changes to the investment style. Some changes may be in the interest of the investors and some may not. Act before any changes materialise as a disappointing performance.

HDFC Balanced Fund has often ranked among the top decile performers in the Aggressive Hybrid Fund category. Its performance in the past over certain periods has even put more aggressive large-cap funds to shame. The aggressive hybrid fund not only boasts of a lower volatility compared to its peers, but has delivered even stronger returns in comparison.

In this brief analysis, we take a close look at the features and performance of HDFC Balanced Fund.

Investment Objective of HDFC Balanced Fund (HDFC Hybrid Equity Fund)

HDFC Balanced Fund has an investment objective to "generate capital appreciation along with current income from a combined portfolio of equity & equity related and debt and money market instruments."

HThe new fund, HDFC Hybrid Equity Fund will follow an investment objective to “to generate capital appreciation and income from a portfolio, predominantly of equity & equity related instruments.”

HDFC Balanced Fund Details

Fund Facts

| Category |

Aggressive Hybrid |

Style |

Blend |

| Type |

Open ended |

Market Cap Bias |

Multi-cap |

| Launch Date |

20-Sep-00 |

SI Return (CAGR) |

16.35% |

| Corpus (Cr) |

Rs 21,779 |

Min./Add. Inv. |

Rs 5,000 / Rs 1,000 |

| Expense Ratio (Dir/Reg) |

0.77% / 1.92% |

Exit Load |

1% |

Portfolio Data as on April 30, 2018.

SI Return as on May 23, 2018.

(Source: ACE MF)

Under normal circumstances, HDFC Balanced Fund allocates…

From June 1, 2018, the new scheme HDFC Hybrid Equity Fund will allocate –

-

65% - 100% to equity and equity related securities

-

20% - 35% to Debt Securities (including securitised debt) and Money Market Instruments.

-

0-10% to REITs and InvITs

-

0-10% to Non-convertible Preference Shares

Growth Of Rs 10,000, If Invested In HDFC Balanced Fund 5 Years Ago

Data as on May 23, 2018

Data as on May 23, 2018

(Source: ACE MF)

Had you invested Rs 10,000 HDFC Balanced Fund, five years back on May 23, 2013, it would have grown to Rs 23,576 as on May 23, 2018. This translates in to a compounded annualised growth rate of 18.70%. In comparison, a simultaneous investment of Rs 10,000 in its current benchmark – CRISIL Hybrid 35+65 Index would now be worth Rs 18,150 (a CAGR of 12.65%). HDFC Balanced Fund has clearly outperformed its benchmark over the period of last 5 years. Bulk of the outperformance came in 2014-15.

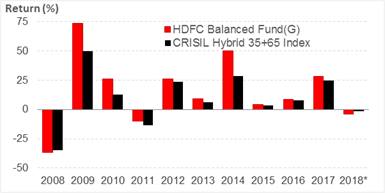

HDFC Balanced Fund: Year-on-Year Performance

YTD as on May 23, 2018

(Source: ACE MF)

HDFC Balanced Fund has a track record of over 15 years. The year on year performance comparison of the fund vis-à-vis its benchmark – CRISIL Hybrid 35+65 Index shows that the fund has outperformed the benchmark in 9 out of last 10 calendar years. In 2008, when the financial crisis hit, the fund underperformed the benchmark when the market crashed. In 2011, HDFC Balanced Fund proved its ability to limit losses during market correction. A large portion of its alpha was generated in the market rallies of CY 2009 and CY 2014. The returns have been subdued in the recent few years. For the year-to-date, the scheme has lagged the benchmark and delivered a negative return.

HDFC Balanced Fund: Performance Vis-à-vis Category Peers

Rolling Period Returns

| Scheme Name |

Corpus (Rs Cr) |

1 Year |

2 Year |

3 Year |

5 Year |

Std Dev |

Sharpe |

| Principal Balanced Fund |

1,255 |

25.89 |

21.12 |

14.78 |

17.89 |

11.68 |

0.20 |

| L&T Hybrid Equity Fund |

10,572 |

18.82 |

15.30 |

13.78 |

19.06 |

9.76 |

0.14 |

| HDFC Balanced Fund |

21,779 |

19.27 |

17.01 |

13.46 |

19.05 |

9.72 |

0.14 |

| DSPBR Equity & Bond Fund |

7,190 |

16.16 |

15.70 |

13.45 |

16.21 |

11.60 |

0.11 |

| ICICI Pru Equity & Debt Fund |

28,807 |

18.16 |

17.54 |

13.32 |

18.83 |

9.67 |

0.14 |

| Reliance Equity Hybrid Fund |

13,426 |

20.13 |

16.20 |

13.14 |

17.40 |

10.30 |

0.13 |

| Aditya Birla SL Equity Hybrid '95 Fund |

14,662 |

16.36 |

15.78 |

12.85 |

17.73 |

9.97 |

0.12 |

| SBI Equity Hybrid Fund |

23,581 |

16.73 |

13.54 |

12.18 |

18.20 |

9.15 |

0.09 |

| Canara Rob Eq. Debt Allocation Fund |

1,616 |

16.71 |

14.11 |

11.77 |

16.34 |

11.39 |

0.09 |

| Franklin India Balanced Fund |

2,087 |

12.81 |

12.13 |

11.62 |

16.72 |

8.41 |

0.07 |

| UTI Hybrid Equity Fund |

6,127 |

17.03 |

15.62 |

11.19 |

14.96 |

10.06 |

0.10 |

| Tata Hybrid Equity Fund |

5,552 |

11.42 |

10.88 |

10.43 |

16.98 |

9.87 |

0.02 |

| Escorts Balanced Fund |

3 |

15.04 |

13.34 |

10.13 |

16.75 |

9.18 |

0.06 |

| Sundaram Equity Hybrid Fund |

1,009 |

14.63 |

14.53 |

9.04 |

11.31 |

9.15 |

0.09 |

| Shriram Equity & Debt Opp Fund |

45 |

14.05 |

10.79 |

8.00 |

0.00 |

10.04 |

0.02 |

| DHFL Pramerica Hybrid Equity Fund |

243 |

11.48 |

9.34 |

7.17 |

13.57 |

10.25 |

-0.03 |

| JM Balanced Fund |

3,684 |

12.40 |

9.73 |

6.41 |

13.74 |

8.94 |

-0.02 |

| LIC MF Balanced Fund |

348 |

10.32 |

9.72 |

5.26 |

10.76 |

12.25 |

-0.07 |

| CRISIL Hybrid 35+65 – Aggr. Index |

|

16.53 |

14.67 |

10.97 |

13.78 |

8.57 |

0.12 |

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on May 23, 2018

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

On rolling return basis, HDFC Balanced Fund is a strong competitor in the balanced fund category. It has delivered above average returns across rolling periods of 1-year, 2-year, 3-year and 5-years. The erstwhile Balanced Fund has done well to beat its benchmark and most of its category peers by a distinct margin.

HDFC Balanced Fund's return comes at slightly higher volatility when compared to the benchmark. Its Standard Deviation of 9.72 is in line with the other peers in the category. The fund's Sharpe Ratio of 0.14 ranks among the top in the balanced fund category.

The top five Aggressive Hybrid mutual funds in the 3-year rolling period performance include—Principal Balanced Fund, L&T Hybrid Equity Fund, DSPBR Equity & Bond Fund, ICICI Pru Equity & Debt Fund and Reliance Equity Hybrid Fund.

Investment Strategy of HDFC Balanced Fund (HDFC Hybrid Equity Fund)

Under normal circumstances, HDFC Balanced Fund has a mandate to invest 60%-70% of its portfolio in equity. However, it strictly maintains an allocation of above 65% into equities, for it to qualify as an equity scheme and enjoy the long-term tax sops.

The fund manager looks to invest in "businesses with superior growth prospects and good management, at a reasonable price". HDFC Balanced Fund does not hold a market-cap bias and tends to maintain a fair mix of mid-caps and large-caps in its portfolio.

TFor the new scheme, HDFC Hybrid Equity Fund, the aim of equity strategy will be to build a portfolio of companies across market capitalization that have

-

reasonable growth prospects

-

sound financial strength

-

sustainable business models

-

acceptable valuation that offer potential for capital appreciation

With a higher allocation to large-caps, HDFC Balanced Fund is able to cushion market downturns. The addition of mid-caps to the portfolio enables the fund to generate a steep outperformance over the benchmark during market rallies. This is why, though the volatility of the fund is higher than the benchmark; it outpaces it in the form of superior risk-adjusted returns.

Under debt, HDFC Balanced Fund maintains the flexibility to invest in the entire range of debt instruments.

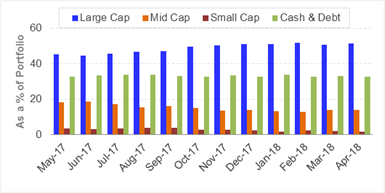

HDFC Balanced Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on April 30, 2018

Holdings (in %) as on April 30, 2018

(Source: ACEMF)

HDFC Balanced Fund usually remains tilted towards large caps, where it allocates about 40% of its portfolio. Mid-and small-caps account for 20%-25% of the portfolio. Over the past year, the scheme has shifted its exposure from mid-and small-caps to large caps. Over the past year, the exposure to large-caps has steadied about 50%, and stands at 51.5% for April 2018, from little over 40% a year ago. The mid- and small-cap exposure has dropped to 15% from about 25% in the previous year. The exposure to debt and cash equivalents have moved in a narrow range of 30%-35% of the portfolio.

HDFC Balanced Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| HDFC Bank |

6.50 |

| Infosys |

3.82 |

| HDFC |

3.38 |

| ITC |

3.25 |

| Larsen & Toubro |

3.10 |

| ICICI Bank |

2.96 |

| Aurobindo Pharma |

1.94 |

| IndusInd Bank |

1.77 |

| Axis Bank |

1.76 |

| Voltas |

1.75 |

|

Top 5 Sectors

|

Holdings (in %) as on April 30, 2018

(Source: ACEMF) |

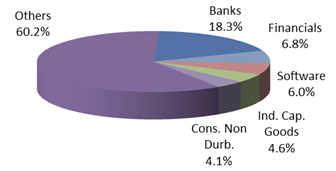

HDFC Balanced Fund usually holds around 50-70 stocks in the portfolio. Currently, it has 63 stocks in its portfolio. The fund's portfolio is not churned often and the fund manager prefers to stay invested for the long term. The top 10 holdings account for 33% of the entire portfolio. Apart from HDFC Bank, Infosys, ICICI Bank, HDFC and L&T are among the top stocks.

The sector-wise allocation of HDFC Balanced Fund remains skewed towards banks. While banks account for 20% of the entire portfolio, HDFC Bank contributes 7% to the entire holdings. The remaining part of the portfolio remains diversified across stocks and sectors.

On the debt side, about 16% of the assets is allocated to corporate debt while 12% is exposed to G-Secs. The debt portfolio offers a yield-to-maturity of 7.35% with an average maturity of around five years. The modified duration of the balanced fund works out to 3.41 years.

HDFC Balanced Fund keeps a higher maturity profile compared to its peers. This would have enabled it to earn a higher return when interest rates and bond yields were on a decline. However, it now poses as a risk, with bond yields on an upward trajectory.

Top Gainers in HDFC Balanced Fund's portfolio

Out of the 63 stocks, about 53 stocks have been held for over a year. This gives a sense that HDFC Balanced Fund prefers to hold the stock for the long term. Among the top performers in the portfolio, with an average holding above 1%, were Balkrishna Industries, Voltas and Aarti Industries. These stocks gained 68%, 57% and 54% respectively over the past year.

There were a few laggards as well. State Bank Of India, Bank Of Baroda, and Bharat Electronics were among the large-caps that declined in value. These stocks fell by 15%, 21% and 21% respectively.

Suitability of HDFC Balanced Fund (HDFC Hybrid Equity Fund)

Aggressive Hybrid Funds (erstwhile Balanced Funds) are a good alternative when equity valuations have deviated significantly from the mean. These set of funds provide stability in a volatile market environment, while have potential to generate superior capital appreciation over longer period, due to significant allocation to equities.

As most existing Balanced Funds maintained an aggressive equity allocation, fund houses have already or may soon classify them under Aggressive Hybrid Funds. It is unlikely to see many fund houses classify funds under the Balanced Hybrid Fund category, as these schemes do not give investors a tax advantage.

Do read: Aggressive Hybrid Fund or Balanced Advantage Fund, Which Is A Better Option?

Under Aggressive Hybrid Funds, a minimum debt allocation of 20% is specified. Unlike Balanced Hybrid Funds, where no Arbitrage is permitted, Aggressive Hybrid Funds have the flexibility to include an arbitrage exposure.

If your balanced fund classification has changed to an Aggressive Hybrid Fund, in all probability you need not worry. The scheme is likely to stick to its existing investment strategy, though there may be a change in the fund name and minor changes in the asset allocation.

Some Hybrid Equity Funds have taken a quantum leap by investing in mid-cap stocks as well. With this aggressive equity allocation, Aggressive Hybrid Funds are able to score massive returns in a bull market. At times, some schemes even outperform many equity-diversified funds. Such funds, like HDFC Balanced Fund, are suitable for aggressive investors with an investment horizon of five years or more.

If you plan to invest in Aggressive Hybrid funds or Hybrid Equity Funds, do ensure that the investments are in line with your financial goals. If you are not sure about how to align these schemes with your tax planning or financial goals, do consult your financial planner or investment advisor.

Note: This write up is for information purpose and not a recommendation to buy or sell the mutual fund scheme. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor.

|

Editor's note:

PersonalFN has a long track record of offering unbiased mutual fund research services. It analyses thousands of data points to shortlist schemes and also applies a whole host of qualitative parameters to select only a handful schemes for your portfolio.

Do try PersonalFN’s Premium Mutual Fund Research service ‘FundSelect’

Every month, our FundSelect service will provide you with an insightful and practical guidance on which mutual fund schemes to buy, hold or sell, which will assist in creating the ultimate portfolio that has the potential to beat the market.

And there’s more great news!

FundSelect is turning FIFTEEN.

And on this auspicious 15th anniversary of FundSelect, we intend to make it “ultra-special” for you.

How?

Well, how about getting 1 Year of access to FundSelect virtually Free?

And if you wish, perhaps even MORE...

Check out the exciting offers that can be availed on subscriptions to FundSelect here.

Go ahead and subscribe to PersonalFN’s FundSelect NOW!

|

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments

| Comments |

singh.lalbabu10@gmail.com

Dec 16, 2018

I have opened my account in HDFC prudence fund the Company has transferred my account to HDFC balance fund by showing

loss in the Fund . Now it is one and a half year,but my account is still showing losses.instead of gain. Monthly account through e mail is not being opened . After my repeated request not still getting monthly account position through hard copy of my account. Thus last performance not meant for current customer. |

singh.lalbabu10@gmail.com

Dec 16, 2018

I have opened my account in HDFC prudence fund the Company has transferred my account to HDFC balance fund by showing

loss in the Fund . Now it is one and a half year,but my account is still showing losses,instead of gain. Monthly account statement through e mail is not being opened. After my repeated request not still getting monthly account position through hard copy of my account. Thus ,last performance not meant for current customer.

|

1