Many investors often invest in mutual fund schemes that have generated attractive returns in the recent past. However, most of them don't consider their risk appetite nor do they look into the risk profile of the schemes they are investing in.

The bad news is investors, repent when their investments make heavy losses.

Small-cap funds have been popular among investors for the last few years. But their performance in 2018 has given investors sleepless nights.

Table 1: How have small-cap funds fared?

Returns less than 1-year are absolute while for the time period over 1-year are compounded annualised. The risk-ratios are calculated over a period of 3 years

(Source: ACE MF)

The BSE SmallCap Index is hammered and it down 27% compared to its January highs and the trend with small-cap mutual funds is no different.

But despite such a steep fall, the BSE SmallCap TRI Index has generated 20.5% CAGR returns over the last five years.

Not bad, right?

That’s why small-cap funds are classified as ‘high-risk-high-return’ investment propositions.

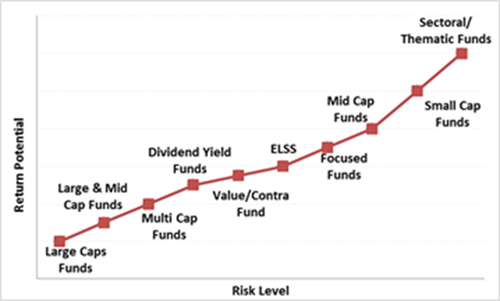

Graph 1: Risk-Return Potential of various equity mutual funds

Although they generate superior returns over a longer time period, they can be highly volatile.

Small-cap funds aren’t for you unless:

- You have the stomach to assume very high risk; and

- Have a time horizon of less than 7-10 years

Why your investment in a small-cap fund can be highly rewarding over a longer tenure?

Small-cap companies can grow faster during the upswings of business cycles or when the overall economy is witnessing accelerated growth. Their revenue and profit growth tend to outpace that of large-cap companies by a significant margin. As a result, investors buy them aggressively when the growth momentum is strong.

If you hold a well-managed small-cap fund/s that picks fundamentally robust companies at reasonable valuations that has the potential of being tomorrow’s large caps, the fund can generate stupendous returns you, the investor.

What makes small-caps highly volatile and therefore risky?

If the inflow of money is consistently rising in the small-cap mutual funds, the fund managers jump on the bandwagon to invest in small caps, even when the valuations are expensive (like they have been for a while now).

Usually, small-cap stocks have low trading volumes due to their size. And because of the risks associated with such stocks, buyers often disappear when markets fall relentlessly. In such a situation, the fund manager may end up holding an illiquid stock or may sell it at a deep discount. At the end of it, your investment in the fund will bear the brunt.

Similarly, if a small-cap fund holds a concentrated portfolio, the fund may experience higher volatility. Plus, small-cap funds that churn their portfolio quite aggressively––follow momentum––may not necessarily be the best performer. Once the momentum in a small cap stock is lost, and/or at worst, if the valuations are high, small-cap funds may take years to reclaim their peaks. Under such a scenario, small-cap funds you may suffer a capital loss.

If you have any small-cap fund in your portfolio that’s underperformed constantly, it’s perhaps time to review your mutual fund portfolio. There could be few more underperformers in your portfolio.

[Read: Unsure When To Review Your Mutual Fund Portfolio? Read This…]

What to expect in the foreseeable future?

Perhaps for the first time in the last 10-15 years, many small caps have generated +20% compounded annualised returns over five years, in the absence of any substantial growth in corporate earnings.

Historically, towards the end of 2013, valuations of many small caps were comfortable due to which investors enjoyed a greater margin of safety. Fast forward to 2018, valuations continue to be expensive, despite a 30%-40% correction in prices.

If smaller companies fail to revive growth, their stocks may correct further. Besides, the potential rise in input cost (inflation), falling Indian Rupee, and volatility in the crude oil market may put enormous pressure on the small-cap companies. Moreover, there would be stock specific undercurrents as well.

As per the SEBI’s (Securities And Exchange Board of India’s) new classification norms, a small-cap fund has to invest at least 80% of their assets in companies beyond top 250 companies. This might discourage mutual funds from investing in companies beyond 100-150 small cap companies. The deeper you trace down the market cap curve, there is a risk of accumulating illiquid companies that less researched.

In case you are planning to invest in a small-cap mutual fund scheme now, remember this:

- Selection of a small-cap fund is extremely crucial since the margin for error is pretty low.

- While selecting a small-cap fund, you need to be all the more careful about portfolio characteristics of the fund.

- Completely avoid investing in a close-ended small cap scheme because they might deny you exit opportunities even when their performance is poor. Such inflexibility can cost you a pretty penny in the end.

- Avoid a small cap fund offered by a fund house that excessively depends on its fund managers and doesn’t have in place sound investment processes and systems.

- Whenever investing in a small cap fund, prefer the Systematic Investment Plan (SIP) route only.

[Read: Should You Be Investing In Mid and Small-Cap Funds Now?]

How to select a small-cap fund wisely?

The process of mutual fund selection, be it a small cap fund or a large-cap fund, remains largely the same. Only that, while choosing a small-cap fund, you should be wary of funds which have a history of exposing investors to higher volatility.

Watch this video:

PersonalFN considers quantitative as well as qualitative factors when choosing the most suitable mutual fund schemes for your portfolio.

[Read: PersonalFN’s research methodology]

In case you wish to take the risk and add small-cap funds, plus want to know the other best equity mutual fund schemes for your portfolio, PersonalFN's unbiased premium research service—FundSelect is meant for you.

Every month, PersonalFN’s FundSelect service will provide you with an insightful and practical guidance on equity mutual funds and debt schemes – the ones to buy, hold, or sell, therefore assisting you in creating the ultimate portfolio that has the potential to top the market.

With FundSelect, you get access to high quality and reliable funds picked by our research team using their comprehensive S.M.A.R.T. score fund selection matrix.

S – Systems and Processes

M – Market Cycle Performance

A - Asset Management Style

R - Risk-Reward Ratios

T - Performance Track Record

If you are serious about investing in a rewarding fund, subscribe to PersonalFN’s flagship mutual fund research service FundSelect today!

PS: Try PersonalFN Direct – PersonalFN’s robo-advisory platform offering only Direct Plans and invest online.

Add Comments