Tata Mutual Fund has launched an open-ended hybrid fund named Tata Multi Asset Opportunities Fund. It will invest predominantly in equity, debt, and exchange-traded commodity derivatives.

What is a Multi Asset Fund?

As per SEBI classification, a Multi Asset Fund invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes.

Some multi asset funds directly invest in equity stocks, debt instruments, and gold units, while some funds invest indirectly in these asset classes.

But the basic purpose of investing in such funds is to diversify investments in assets classes that share a negative correlation each other. A very low positive correlation between any two asset classes indicates that they are unlikely to move in the same direction.

It has been observed in the past that gold and equity share a low correlation with each other. And, hence, having these two asset classes in your portfolio can help diversify it better.

While debt is considered safer than equities; equities can generate superior returns. And, including gold would improve the diversification of your portfolio.

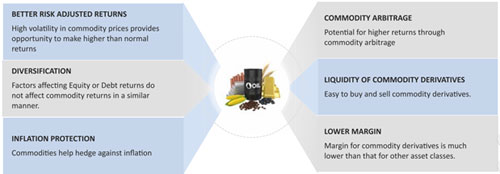

Though lot of schemes are floating in the markets that are offering equity and debt exposure currently, but not much is talked of the effective use of commodities held in the fund's portfolio. Although there are some funds that have been introduced in the past, especially with the inclusion of gold, but none have been done with the inclusion of the plethora of other commodity options available since the improved conditions of the commodities market in India.

Image 1: Benefits of investing in commodity

(Source: Tata Multi Asset Opportunities Fund Presentation)

(Source: Tata Multi Asset Opportunities Fund Presentation)

Tata mutual fund is of the view that commodity investments present an array of benefits to the investor. Through multi asset mutual funds, commodities help potentially enhance the returns of Equity and Debt portfolios while reducing risk. Hence it introduced Tata Multi Asset Opportunities Fund.

However, do note that TMAOF will allocate its assets primarily heavily to equities in a range of 65% to 80%, followed by debt and commodities. Besides commodities markets also expose the investors to certain risks: 1. For arbitrage trades - Operational challenges 2. For Calendar Spreads and Directional Trades - Systemic and Un-systemic Risks. So, the fund is a moderately high-risk investment proportion and consider only if you have an investment horizon of 5 years or more.

Table 1: Tata Multi Asset Opportunities Fund details

| Type |

An open-ended scheme investing in equity, debt and exchange traded commodity derivatives. |

Category |

Multi-asset allocation hybrid fund |

| Investment Objective |

The investment objective of the scheme is to generate long term capital appreciation.

However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns. |

| Min. Investment |

Rs 5,000/- and in multiple of Re 1/- thereafter |

Face Value |

Rs 10 per unit |

| Plans |

*Default |

Options |

*Default option |

| Entry Load |

Nil |

Exit Load |

1% if redeemed/switched out within 1 year from the date of allotment |

| Fund Manager |

Mr Rahul Singh, Mr Sailesh Jain, Mr Murthy Nagarajan and Mr Aurobinda Prasad Gayan |

Benchmark Index |

Composite Benchmark of 65% S&P BSE 200 + 15% CRISIL Short Term Bond Fund Index + 20% iCOMDEX Composite Index (Total Return variant of the index (TRI) will be used for performance comparison). |

| Issue Opens |

14 February, 2020 |

Issue Closes: |

28 February, 2020 |

(Source: Scheme Information Document)

How will the scheme allocate its assets?

Under normal circumstances, the scheme's asset allocation will be as under:

Table 2: TMAOF's Asset Allocation

| Instruments |

Indicative Allocation (% of Net Assets) |

Risk Profile |

| Minimum |

Maximum |

| Equity and equity related instruments |

65 |

80 |

Medium to High |

| Debt and money market instruments |

10 |

25 |

Low to Medium |

| Commodity ETFs, Exchange Traded Commodity Derivatives (ETCDs) & any other mode of investment in commodities as permitted by SEBI from time to time. |

10 |

25 |

Medium to High |

| Units issued by REITs and InvITs |

0 |

10 |

Medium to High |

Notes:

- Investment in securitized debt (excluding foreign securitized debt) will be restricted to 25% of the net assets of the Scheme.

The Scheme will not invest in credit default swap.

- Investment in REITs & INvITs will be subject limits and other restrictions as may be specified by SEBI from time to time.

(Source: Scheme Information Document)

What will the Investment Strategy be?

With the objective clearly defined, the investment manager will distribute assets of the scheme in following categories of Equity, Debt, and Commodities. The major part of the investment shall be in Equity and Equity related instruments to maintain the gross exposure of the scheme at 65 per cent or above; while, the remaining corpus shall be invested in Debt & Money Market instruments and permitted instruments in Indian Commodities market.

Equity & Equity Related Instruments

The Scheme will invest predominantly in equity/equity related instruments. Within the stated allocation range, actual allocation to Equity assets and Equity related instruments will depend upon an internally driven process based on:

-

Fundamental outlook for equity markets and the prevailing valuation framework,

-

The macroeconomic environment (including interest rates and inflation) and

-

General liquidity and technical considerations.

The investment strategy would therefore entail use of equity derivatives to manage the equity exposure as necessitated by the above factors.

The fund manager may choose to dynamically manage the gross and net Equity exposure to achieve the investment objective. The Scheme proposes to take a long-term call on stocks which based on the investment philosophy of "Growth at Reasonable Price", offers superior risk-reward. While macro and economic outlook will be given adequate importance in stock selection, the research process would include detailed bottom-up analysis of the respective sector, company's market position, management track record, corporate governance track record, and growth outlook in profits.

The Scheme may also take exposure to various equity derivatives including futures and option strategies, as may be permitted by SEBI. Time to time, the fund manager may use derivatives to hedge (full or part) equity portfolio.

Debt & Money Market Instruments

The Scheme would invest in companies based on various criteria including sound professional management, track record, industry scenario, growth prospects, liquidity of the securities, etc.

The Scheme will emphasize on well managed, good quality companies with above average growth prospectus whose securities can be purchased at a good yield and whose debt securities are concerned investments (wherever possible) will be mainly in securities listed as investments grade by a recognized authority like The Credit Rating and Information Services of India Limited (CRISIL),ICRA Limited (formerly, Investment Information and Credit Rating Agency of India Limited), Credit Analysis and Research Limited (CARE) etc.

In case of investments in debt instruments that are not rated, specific approval of the Board will be taken except in case of Government Securities being sovereign bonds. However, in case of investment in unrated securities prior board approval is not necessary if investment in within the parameters as stipulated by the board.

Commodities

Pertaining to commodities the scheme shall invest in the appropriate Exchange Traded Commodity Derivatives (ETCD) or ETFs with commodity underlying or any other permissible instruments linked with commodity prices. The investment will not be limited to non-agriculture commodities while the scheme shall also be looking at opportunities in various agriculture commodities, baring a few sensitive commodities as indicated in the SEBI guidelines. Under commodity derivatives the scheme shall invest in both futures and options contracts of underlying assets.

During trading or investing in commodities derivatives the scheme might have to take physical delivery of the commodities through the commodity exchange contracts. In such a case, the mutual fund house shall dispose of such goods from the books of the scheme at the earliest, not exceeding 30 days from the date of holding of the physical goods.

Long-term investments in commodities will be based on the commodity fundamentals driven by comprehensive research studies, demand-supply, roll-over cost mechanism and other macro-economic factors. Short term investment will be to capture arbitrage opportunities, price corrections or other event-based opportunities in the market.

REITs & InvITs

Investment in REITs or InvITs will be made based on the various factors such as liquidity, sector outlook and returns expectations. The investment across asset class within the stated range will be based on opportunities available in the different asset classes and outlook for the Markets.

Who will manage Tata Multi Asset Opportunities Fund?

The Tata Multi Asset Opportunities Fund will be co-managed by four fund managers. Each one will be looking into different asset class of the fund's portfolio. Mr Rahul Singh will primarily manage the unhedged equity portfolio of the scheme, Mr Sailesh Jain will manage the hedged /derivative exposure of the scheme, Mr Murthy Nagarajan and Mr Aurobinda Prasad Gayan will manage the commodity portfolio.

Mr Rahul Singh holds a Bachelor's degree in Engineering (B.E.) and has a PGDM to his credit and has 23 years of experience of Equity research.

He is Chief Investment Officer - Equities at Tata Asset Management Ltd. Prior to it, he has worked with Ampersand Capital Investment Advisors LLP as Managing Partner for 3 years. Besides that, for 5 years he worked as a Managing Director at Standard Chartered Securities Ltd and with Citigroup Global Markets for nearly 5 years as Senior Research Analyst reporting to Head of Research.

Currently at the Tata AMC, Mr Rahul Singh manages Tata Balanced Advantage Fund.

Mr Saliesh Jain has done his MBA in Finance and has been a part of Tata Asset Management Ltd since November 2018 as a fund manager. Preceding to it he has been with IDFC Securities Ltd., Quant Broking Pvt. Ltd. and IIFL (India Infoline).

Currently at the Fund house, Mr Sailesh Jain some of the other schemes he manages include: Tata Digital India Fund, Tata Equity Savings Fund (Equity Portfolio), Tata India Pharma and Healthcare Fund, Tata Resources and Energy Fund, Tata Arbitrage Fund, Tata Nifty Exchange Traded Fund, Tata Nifty Private Bank Exchange traded fund and Tata Quant Fund.

Mr Murthy Nagarajan holds a Master of Commerce degree, has completed his PGDBA from Somaiya Institute of Management & Research and done his ICWA (inter). He has 23 years of experience in debt portfolio and is the Head of Fixed Income at the fund house.

Prior to his appointment at Tata Asset Management, Mr Murthy Nagarajan was working with Quantum AMC. He was also associated with Mirae Asset Global Investment India Ltd in the Investment Department as the Head of Fixed Income for more than two years.

Currently at the Fund house, Mr Murthy Nagarajan some of the other schemes he manages include: Tata Hybrid Equity Fund(Debt Portfolio),Tata Medium Term Fund, Tata Short Term Bond Fund, Tata Equity Savings Fund (Debt Portfolio), Tata Retirement Savings Fund(Debt Portfolio)- Progressive, Moderate & Conservative Plan.

Mr Aurobinda Prasad Gayan is the Head of Commodities Strategy at Tata Asset Management. He has over 14 years of experience in the areas of Financial Research, Currency & Commodity Analysis Management. Mr Aurobinda is a gold medalist in "Operations research" and has completed his MBA Finance from Cochin University.

Before joining Tata Asset Management Company in December 2018 as Head Commodity Strategies, he has worked with Kotak Commodities Services Pvt. Ltd. as Research Head, Reporting to Chief Executive Officer, and with Karvy Comtrade Ltd. as Research Head for overt 9 years.

The outlook for Tata Multi Asset Allocation Fund

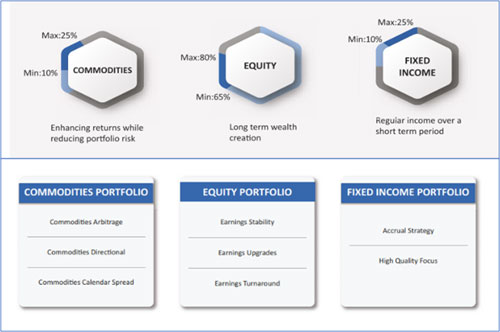

To achieve the stated objective of the scheme, Tata Multi Asset Allocation Fund have an actively managed portfolio comprising of commodities, equities (hedged and unhedged), and fixed income. The asset allocation of the scheme will be such that it would capture the potential gains across market phases through a combination of asset classes. A multi asset fund has the advantage of capturing opportunities to generate returns as shown below.

Image 2: Proposed Asset allocation and indicative investment style

(Source: Tata Multi Asset Opportunities Fund Presentation)

(Source: Tata Multi Asset Opportunities Fund Presentation)

However, do note that, TMAOF's investment across different asset classes with negative correlation brings in distinctly different risk/return characteristics, along with use of Exchange Traded Commodity Derivatives (ETCDs) making it the first. But the portfolio asset allocation is heavily skewed towards equity making it more volatile.

Hence the performance of the Tata Multi Asset Allocation Fund weighs on the stocks held in the portfolio of the scheme. Currently there are opportunities to do value stock picking, but the earnings don't justify the valuation levels. Most of the corporates' third quarter earnings have been dampening due to the drop in consumption and continued slowdown in India's economy. Besides the global outspread of the Novel Coronavirus is an erosion to corporates dealing with Chinese goods and services that will weigh heavily on the markets.

So, the construction of the portfolio would be a challenge for the fund manager to spot opportunities in the current environment and the risk management measures they adopt. Therefore, although there may be good opportunities in the long run, the risk could be very high as well. PersonalFN is of the view that understanding the overall implications is important before investing.

Editor's note: The last few years have not been among the best for equity mutual funds. While most funds have underperformed or are struggling to match the returns of the benchmark, there are few funds that have the potential to constantly generate alpha for its investors. And we have identified five such high alpha generating funds, in our latest report 'The Alpha Funds Report 2020'. Do not miss our latest research finding. Get your access to this exclusive report, right here!

Add Comments