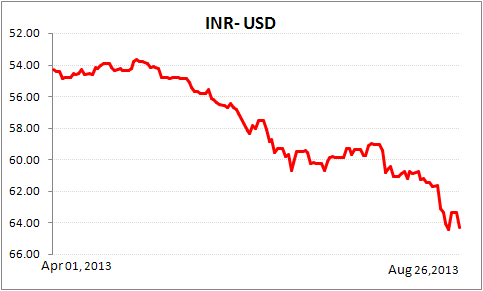

For long, Indians have believed that stocks are more volatile than bonds but now they are witnessing that even the inverse is possible. Yield curve is inverted at present which suggests that investors are demanding more rates on debt with short maturities than the longer ones. In other words, liquidity is tight and preferences for liquidity are high. One of the prime reasons for such destabilisation in the bond market is massacre of rupee. Indian currency has fallen as much as 18% since the beginning of the Financial Year (FY) 2013-14.

Tumbling Rupee

Data as on August 26, 2013

(ACE MF, PersonalFN Research)

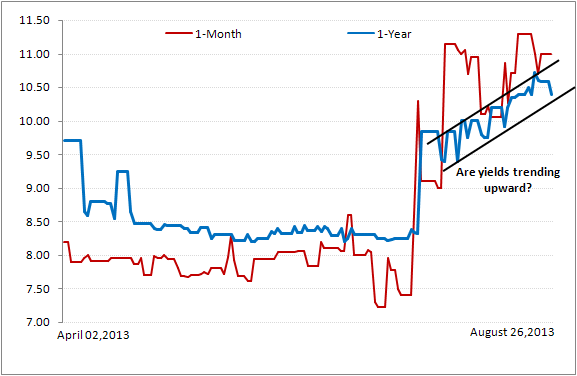

To contain the fall, RBI intervened aggressively. Along with selling dollars, it increased short-term borrowing rates for banks. By doing so RBI hoped to curb speculation in the forex market arising on account of easy liquidity. This took markets by surprise and meeting short-term liquidity needs became a pricy affair for banks. It also made borrowing expensive for corporate. Impact of rising short-term yields was witnessed even on the longer end of the yield curve, as yields went northward even on papers with longer maturities.

Impact on debt fund investors...

Mark-to-market losses (i.e. losses arising due to valuing portfolio at market rate) dented the performance of debt mutual funds. Rising yields made bonds lose their value and in turn, accounted for losses in debt mutual funds. As per regulations, mutual funds have to mark-to-market those instruments which have a residual maturity of more than 60 days. Sudden spike in short-term rates caused even liquid and liquid plus funds register losses. Under such extreme volatile conditions even long-term investors were obviously hesitant to invest in funds with longer average maturities. While short-term income funds may seem attractive to some due to rise in yields and invest, even mutual fund houses are taking this as an opportune time to launch more Fixed Maturity Plan (FMPs).

What is FMP?

FMP is a close ended debt fund that invests in instruments having a maturityconcurrentto that of the fund itself. The fund tries to lock the yields at the time of investment for the fixed time horizon and holds the portfolio till maturity. FMPs may safeguard you against some key risks such as interest rate risks since the portfolio is held till maturity and there is no marking to market involved.

Where do they invest?

FMPs predominantly invest in Certificate of Deposits (CDs) issued by banks and Commercial Papers (CPs) offered by corporate. They also invest in Non-Convertible Debentures (NCDs) but hold limited exposure to them, because more often they are traded and hence carry a mark to market risk. FMPs may also invest in non-tradable corporate debt and money market instruments.

Why FMPs now?

FMPs are more suitable when yields are high and there is still uncertainty about their future course of interest rates and underlying factors thereto.Yield on 7.16% 2023, 10-year benchmark G-Sec bond has been extremely volatile. Volatility has crept in due to persistent weakness in the Indian rupee, widening CAD, pressure on fiscal deficit (with the Government losing it purse strings ahead of general elections next year) and concerns of a rating downgrade on India. Likewise the short-termyields, such as thoseon CDs and CPs are also elevated at present.And given the squeeze in liquidity, it is unlikely to see yields on CDs and CPs dropping drastically. You see, since banks have been making upward revisions in their bank rates, a rate used as a benchmark for pricing loans, borrowing is getting even more expensive for corporate, which in turn is pushing yields on CPs even higher as compared to that on CDs.

Spike in Yields of CDs

Data as on August 26, 2013

(Source: The Fixed Income Money Market and Derivatives Association of India, PersonalFN Research)

However, at some point the Reserve Bank of India (RBI) may have to give due weightage to the infusion of sufficient liquidity in the system. It may happen in any form, Open Market Operations (OMOs) or through reduction in Cash Reserve Ration (CRR) or by way of some other measures. RBI has acknowledged the need of addressing liquidity issues by conducting OMOs worth Rs 16,000 crore for liquidity infusion few days ago.

PersonalFN is of the view that, unless rupee stabilises and recovers, RBI may not be able to soften its stance on short-term rates. This may also keep liquidity situation tight even in future. India has a problem of financing nearly U.S. $70 billion worth Current Account Deficit (CAD). This is a huge challenge. Weaker rupee may continue to put pressure on CAD and therefore even bond yields - where the impact would be felt more at the longer end of the yield curve. Recently yield on 10-year benchmark G-Sec bond had moved close to 9.50% although it came off sharply, highlighting volatility. Betting on longer end of the yield curve may be risky even if you have a longer time horizon.

PersonalFN believes investors should not hold more than 20% of their debt portfolio in long-term income / debt funds. Similarly, while investing in FMPs you should opt for funds with shorter maturities. FMPs would not only enable you to benefit from higher yields but would also help you generate higher post-tax returns, especially if you fall in the maximumtax bracket. Capital gain tax on FMPs is 10% without indexation or 20% with indexation if maturity is above 365 days. FMPs have a relatively lower expense ratio which makes them appealing investment proposition considering today's market scenario.

Add Comments