Is Tata Nifty Midcap 150 Momentum 50 Index Fund a Worthwhile Portfolio Diversifier?

Mitali Dhoke

Oct 11, 2022

Listen to Is Tata Nifty Midcap 150 Momentum 50 Index Fund a Worthwhile Portfolio Diversifier?

00:00

00:00

Given the current market conditions, mid-cap and small-cap stocks have significantly dropped in price and are available at lower valuations. Many investors consider it a good entry-point to diversify their portfolio in mid-cap and small-cap funds. The Mid-cap companies are considered to be emerging future market leaders or future large caps.

Mid-cap investing intends to capture companies with growth potential and evolving business models that carry moderate risk. Investing in the mid-cap segment through passive funds is a suitable alternative for investors who can stomach the high risk and are seeking a low-cost passive option for their mid-cap portfolio. Passively managed midcap funds are less risky than vanilla midcap funds and generate similar returns.

If you are looking for long-term growth opportunities in the mid-cap segment, along with inflation-beating returns over time, you could consider investing in the Nifty Midcap 150 Momentum 50 Index. The top seven sectors with the highest exposure in the Nifty Midcap 150 Momentum 50 Index include capital goods, consumer services, chemicals, information technology, power, realty, and textiles. In addition, the momentum factor in the underlying Index aims to profit from market volatility by buying short-term positions in equities that are rising and selling them as soon as they start to fall.

Tata Mutual Fund has launched a factor-based passively managed fund - Tata Nifty Midcap 150 Momentum 50 Index Fund. It is an open-ended scheme replicating/tracking NIFTY Midcap 150 Momentum 50 Index. The scheme aims to select the top 50 momentum stocks from the midcap universe. While Large caps may provide stability and Small caps may provide potential for high returns, the Mid-cap segment may possibly be a sweet spot in terms of earnings stability and growth prospects.

Table 1: Details of Tata Nifty Midcap 150 Momentum 50 Index Fund

| Type |

An open-ended scheme replicating/tracking NIFTY Midcap 150 Momentum 50 Index. |

Category |

Index Fund |

| Investment Objective |

The investment objective of the scheme is to provide returns, before expenses, that are commensurate with the performance of the NIFTY Midcap 150 Momentum 50 Index (TRI), subject to tracking error. There is no assurance or guarantee that the investment objective of the scheme will be achieved, and the scheme does not assure or guarantee any returns. |

| Min. Investment |

Rs 5,000 and in multiples of Re 1/- thereafter. Additional Purchase Rs. 1,000/- and in multiples of Re. 1/- thereafter. |

Face Value |

Rs 10/- per unit |

| SIP/STP/SWP |

Available |

| Plans |

|

Options |

|

| Entry Load |

Not Applicable |

Exit Load |

0.25 % of the applicable NAV, if redeemed on or before 90 days from the date of allotment |

| Fund Manager |

Mr Shailesh Jain |

Benchmark Index |

NIFTY Midcap 150 Momentum 50 Index (TRI) |

| Issue Opens |

October 04, 2022 |

Issue Closes |

October 17, 2022 |

(Source: Scheme Information Document)

The investment strategy for Tata Nifty Midcap 150 Momentum 50 Index Fund will be as follows:

Tata NIFTY Midcap 150 Momentum 50 Index Fund is a passively managed Index Fund which will employ an investment approach of the scheme is to provide returns, before expenses, that commensurate with the performance of the NIFTY Midcap 150 Momentum 50 Index (TRI), subject to tracking error.

The investment strategy would revolve around reducing the tracking error to the least possible through rebalancing of the portfolio, considering the change in weights of stocks in the Index as well as the incremental collections/redemptions from the scheme. The performance of this scheme may not be commensurate with the performance of the underlying Index on any given day or over any given period. Such variations are commonly referred to as tracking errors. The scheme intends to maintain a low tracking error by aligning the portfolio in line with the Index.

Image source: www.freepik.com

Image source: www.freepik.com

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

The portfolio shall be rebalanced within 7 calendar days to ensure adherence to the asset allocation norms of these schemes. The scheme may also invest in money market instruments to meet the liquidity and expense requirements.

Under normal circumstances, the asset allocation will be as under:

Table 2: Asset Allocation for Tata Nifty Midcap 150 Momentum 50 Index Fund

| Instruments |

Indicative Allocations (% of Net Assets) |

Risk Profile |

| Minimum |

Maximum |

High/Medium/Low |

| Securities covered by NIFTY Midcap 150 Momentum 50 Index |

95 |

100 |

Very High |

| Debt & Money Market Instruments |

0 |

5 |

Low to Medium |

(Source: Scheme Information Document)

About the benchmark

The Nifty Midcap150 Momentum 50 Index aims to track the performance of the top 50 companies within the Nifty Midcap 150 selected based on their Normalised Momentum Score. The Normalised Momentum Score for each company is determined based on its 6-month and 12-month price return, adjusted for volatility. Stock weights are based on a combination of the stock's Normalised Momentum Score and its free-float market capitalisation.

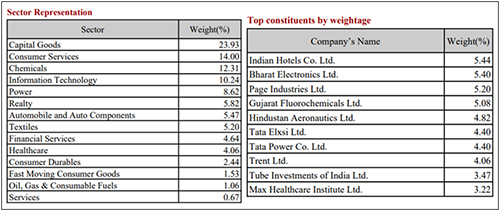

Here is the list of the top 10 constituents by their weightage and sector representation under the Index as of September 30, 2022:

(Source: NSE Nifty Midcap 150 Momentum 50 Index)

(Source: NSE Nifty Midcap 150 Momentum 50 Index)

Note that the Index will rebalance semi-annually in June and December.

Who will manage Tata Nifty Midcap 150 Momentum 50 Index Fund?

The designated fund manager for this scheme will be Mr Shailesh Jain. He holds an MBA (Finance) degree. Prior to joining Tata AMC, he was working with IDFC Securities Ltd as Head of Derivatives - Institutional sales., Quant Broking Pvt Ltd. as Vice President - Institutional Sales - Derivatives and cash and IIFL (India Infoline) as Vice President - Institutional Sales -Head Equity Derivatives.

At Tata Mutual Fund, Mr Jain currently manages Tata Equity Savings Fund (Equity Portfolio), Tata Balanced Advantage Fund, Tata Nifty Exchange Traded Fund, Tata Nifty Private Bank Exchange Traded Fund, Tata Quant Fund, Tata Multi-Asset Opportunities Fund, Tata Dividend yield Fund, Tata Business Cycle Fund, and Tata Arbitrage Fund.

Fund Outlook - Tata Nifty Midcap 150 Momentum 50 Index Fund

Tata Nifty Midcap 150 Momentum 50 Index Fund aims to invest in securities comprising the Nifty Midcap 150 Momentum 50 Index and generate parallel returns, subject to tracking errors. The scheme endeavours to benefit from factor investing through a momentum factor strategy.

Midcap stocks coupled with momentum as a filter have shown remarkable results earlier. The fund would look at the last 6-12-month price performance for volatility and free float to determine momentum. The fund will track the performance of the top 50 companies with high momentum from the Nifty Midcap 150 Index universe. The underlying Index aims to capture the swift movement of midcap stocks across sectors. Amidst the pandemic uncertainties, the momentum index adapted to the market swings at the time of the next rebalancing and increased its exposure to suitable stocks and sectors accordingly. The dynamic nature of the Index makes investing beneficial for the investor over the long term.

The scheme endeavours to capitalise on volatile market trends by investing in stocks that are on their way up and selling them before the prices start falling as per the underlying Index. The momentum method is a risky and aggressive investment strategy built on the premise that stocks and sectors with a recent track record of success will continue to do so and vice versa.

This makes the scheme a high-risk, high-return investment proposition, as the funds focusing on momentum investing may go through a period of underperformance if there is any sharp change in market dynamics. The fortune of this scheme depends on the performance of the underlying Index. Additionally, the persistent repercussions of geopolitical tensions, spiralling inflation, and a hike in policy rates to curb demand and control inflation may cause a significant risk to economic growth. The margin of safety appears to be narrow, and the clear direction for the equity market from the current elevated levels is uncertain. These factors, among others, may impact the top constituents of the Index, and the portfolio may face intensified volatility in the near term.

Thus, the scheme is suitable for refined investors who understand the mid-cap market space and could bear the high risk due to higher volatility. However, mid-cap and small-cap funds may not do well in the near future; you must invest in them only if you have a long horizon of at least 5-7 years to sustain various market phases.

PS: If you wish to select actively managed worthy mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

As a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

PersonalFN recommendations go through our stringent process that assesses both quantitative and qualitative parameters, providing you with Buy, Hold, and Sell recommendations on equity and debt mutual fund schemes. Read here for more details...

If you are serious about investing in rewarding mutual fund schemes, Subscribe now!

Warm Regards,

Mitali Dhoke

Research Analyst