Should the Rate Cut on Small Schemes Deter You from Investing

Listen to Should the Rate Cut on Small Schemes Deter You from Investing

00:00

00:00

If you recall I had wrote to you about a probable rate cut in the article", " Will The Small Saving Schemes Witness A Rate Cut Going Forward?

And just yesterday I came across a news reporting that after much deliberation finally, the Finance Ministry implemented a rate cut on the small saving schemes for the first quarter (Q1) of FY20-21. It has been a while since the last rate cut happened for the second quarter of financial year 2019-20, on small saving schemes of 10-basis points that was put into effect on 1st July 2019, till 30th September 2019.

[Read: The Impact Of Interest Rate Cut In Small Saving Schemes On You]

Since the government reviews and notifies about the interest rates of small saving schemes on a quarterly basis, for the last several quarters, despite the RBI nudging the finance ministry to cut rates, it had been reluctant.

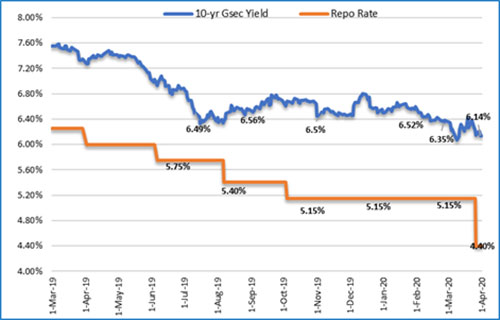

But the 10-Year Benchmark Yield has been slipping ever since the decision of repo rate cuts except in the 5th and 6th bi-monthly monetary policy meetings held.

Graph: Movement of 10 yr Gsec yield and repo rate for last one year

Data as of April 1, 2020

Data as of April 1, 2020

(Source: RBI, PersonalFN Research)

The g-sec has dropped from 7.35% on March 29, 2019 to 6.14% on March 31, 2020 after the latest policy meeting. Looking at the ongoing pandemic and decision taken by the Monetary Policy Committee of RBI in its Seventh Bi-monthly Monetary Policy meeting to reduce rates of the following:

-

The policy repo rate under the liquidity adjustment facility (LAF) by 75 basis points to 4.40 per cent from 5.15 per cent with immediate effect

-

The marginal standing facility (MSF) rate and the Bank Rate stand reduced to 4.65 per cent from 5.40 per cent

-

The reverse repo rate under the LAF stands reduced by 90 basis points to 4.0 per cent

Image source: Business photo created by d3images - www.freepik.com

Image source: Business photo created by d3images - www.freepik.com

Along with the collective decision of the members of MPC to reduce the repo rate, the RBI also decided to continue with the accommodative stance as long as it is necessary to revive growth and mitigate the impact of coronavirus (COVID-19) on the economy, while ensuring that inflation remains within the target.

The MPC decisions were in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

It did not bode well for the finance ministry, headed by Ms Nirmala Sitharaman, so it gave its nod to reduce rates of all the small schemes except the savings deposit. The rate cut is between 70 basis points and 140 basis points. Given below are the revised rates.

Table: Revised Interest rates for small saving schemes

(Source: Department Of Economic Affairs)

(Source: Department Of Economic Affairs)

The reason behind this step of reducing rates is to deal with the current beaten down economy and continue to be in line with the prevailing market rates, as the lockdowns have faltered the global economic activity. Even the Federal reserve have cut rates recently, in order to help contain the slowdown of the economy due to the outbreak of COVID-19.

The overall economy has witnessed a liquidity crunch, and due to the lockdown, all major sectors including trade and manufacturing sectors have been adversely affected and the current GDP reflects the increased pressure on demand.

As reported by the RBI, "The second advance estimates of the National Statistics Office released in February 2020 implied real GDP growth of 4.7 per cent for Q4:2019-20 within the annual estimate of 5 per cent for the year as a whole. This is now at risk from the pandemic's impact on the economy. High frequency indicators suggest that private final consumption expenditure has been hit hardest, even as gross fixed capital formation has been in contraction since Q2:2019-20."

In a move to match the softening of interest rates in the banking sector with the repo rate cut of RBI, and to reduce the borrowing costs so that they are passed on to the consumers, the expected cut came into effect from April 1, 2020, in order to push spending and economic activity.

The past rate cuts are being gradually transmitted to the proletariat economy with several banks reducing their fixed deposits rates further. And the current low economic growth shows the benign inflation outlook that prevails may provide headroom for policy action to close the negative output gap.

But this is a whammy for the investors, especially the senior citizens' savings, as many Indians still find these government saving schemes attractive investments because they provide a higher rate of return than the bank FDs despite the rate cut.

However, the interest earned through these schemes is taxable so the gains will be limited in future and will not help in creating wealth for you in times of rapid inflation and might be not as appealing.

So, be sensible and have an astute investment strategy that will help you create wealth and one that stands in good stead for your long-term financial well-being.

Warm Regards,

Aditi Murkute

Senior Writer