Is a Personal Loan a Good Idea This Festive Season?

Listen to Is a Personal Loan a Good Idea This Festive Season?

00:00

00:00

The festive season is around the corner and the markets are already flooded with discounts and offers to attract potential customers. While the pandemic crisis still grips the financial situation of many Indian households, the demand for goods and services generally surges during the festive season. Many of us save money for an entire year to fulfil our specific desire and we receive increments and bonuses that we can't wait to spend! But, sometimes the savings and bonuses are just not enough, and that is when we are tempted to get a personal loan!

Personal loans can be very helpful in an emergency or during a financial crunch because these can be availed of with minimum documentation and do not require any collateral. Many banks are now offering instant personal loans available online within a few minutes to specific customers.

Although a personal loan can be used for any purpose, most people tend to avail it for luxuries that could be otherwise postponed. However, almost all finance experts recommend availing of a personal loan only in case of an emergency. Repayment of personal loan EMIs can put a dent in your budget and other financial goals because of its high rate of interest and charges.

(Image Source: www.freepik.com)

(Image Source: www.freepik.com)

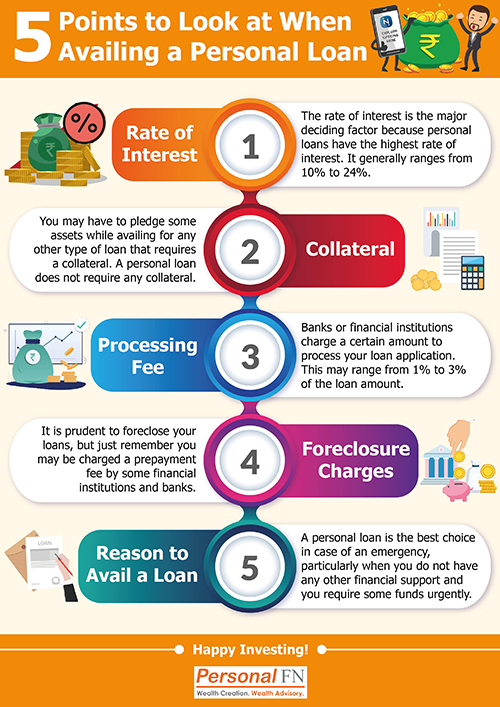

A personal loan has its advantages and disadvantages; here are the factors to consider before you avail of a personal loan:

-

Rate of Interest:

The rate of interest is the major deciding factor because personal loans have the highest rate of interest. It generally ranges from 10% to 24%. When your repayment tenure is a longer duration of 4-5 years, you end up paying a lot more than the principal amount. Many banks lure customers with festive season offers by marginally reducing the rate of interest by 0.20% to 0.50%. Advisably, if your credit history is sound and credit score is high, you can use it as leverage to negotiate a better rate of interest with your bank.

-

Collateral:

The biggest advantage of a personal loan is that it does not require any collateral. This means you do not have to pledge any assets as you would for any other type of loan that requires a collateral. Most personal loans are unsecured; therefore, not having collateral ultimately increases the rate of interest.

-

Processing Fee:

The processing fee is another concern when it comes to a personal loan. The banks or financial institutions charge a certain amount to process your loan application. This processing fee can range from 1% to 3% of the loan amount. If you are a long-time customer of the bank and have a good CIBIL score, you can always negotiate on the processing fee. Also, some of the leading banks, including HDFC Bank, Axis Bank, etc., are offering up to 50% discount on processing fee this festive season.

-

Foreclosure Charges:

It is prudent to foreclose your loans to save the interest payment on future EMIs whenever you have adequate funds. Just remember that most banks and financial institutions charge pre-payment fees if you want to foreclose your personal loan. The charges vary from company to company, and generally range between 2 to 5%, which makes a big difference, especially when the dues are high.

-

Reason to Avail a Loan:

First, it is crucial to analyse your needs and wants so you can resist the temptation to splurge if it is not an absolute necessity. A personal loan is the best choice in case of an emergency, particularly when you do not have any other financial support and need funds urgently. Sadly, most times people apply for personal loans for instant gratification and put themselves under stress, paying hefty EMIs. So, if you want to buy that gadget, jewellery or luxury item that can easily be postponed, think again and do not take on a personal loan.

Final Thoughts:

A personal loan helps you manage excess expenses and can be availed of online within a few minutes. You can buy your favourite smartphone or jewellery almost instantly with quick and easy access to funds. Although this type of loan does not require any collateral or guarantor, you can end up paying a very high rate of interest and processing fee. We advise availing of a personal loan only in case of an emergency when you do not have any assets to pledge and getting a personal loan is the only option left. A personal loan can be a boon in challenging times or a curse when it is a hasty decision! If you need to get a personal loan, do your research by checking the rates of interest and processing fee with various banks and financial institutions. Next, discuss any negotiable aspects with your bank and check the foreclosure charges, etc., and most importantly, reconsider the reasons for availing a personal loan and postpone and save up instead.

Warm Regards,

Ketki Jadhav

Content Writer

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds