How to Choose the Right Personal Loan Lender?

Ketki Jadhav

Jul 25, 2022

Listen to How to Choose the Right Personal Loan Lender?

00:00

00:00

Personal Loans are ideal during financial emergencies and cash crunch. With many banks and Non-Banking Financial Companies (NBFCs) offering different kinds of Personal Loans, such as regular Personal Loans, Instant Personal Loan, Pre-approved Personal Loan, Pre-qualified Personal Loan, etc., and aggressively promoting them, getting a Personal Loan has become much easier and faster than how it was a decade ago. That said, making a decision in haste and not choosing the right Personal Loan and lender can lead to future disappointment. Read this article before opting for a Personal Loan to avoid such disappointments in the future, as it will help you choose the right Personal Loan lender.

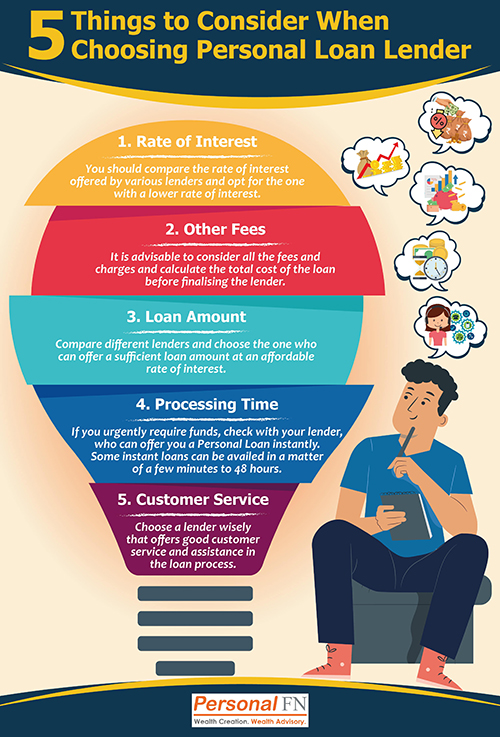

Here are 5 important things you should evaluate when choosing the right Personal Loan lender:

1. Rate of Interest:

When choosing the Personal Loan Lender, the rate of interest should be the major deciding factor because personal loans have the highest rate of interest, and it generally ranges from 11% p.a. to 28% p.a. When your repayment tenure is a longer duration of 4-5 years, you end up paying a lot more than the principal amount. Many banks lure customers with different offers by marginally reducing the annual interest rate by 20bps to 50bps ( i.e. 0.20% to 0.50% p.a). Advisably, if your credit history is sound and your credit score is high, you can use it as leverage to negotiate a better rate of interest with your bank. Also, many lenders offer No Cost EMIs or Zero Interest EMIs on purchases of consumer durables. However, the lenders often recover the interest amount from the processing fee or do not give cash discounts that you would otherwise get. Hence, you should check and compare your total outgo and make an informed decision when choosing a Personal Loan Lender.

2. Other Fees:

The interest rate is not the only cost you pay to avail of a loan. The banks or financial institutions charge a certain amount to process your loan application. This processing fee could be a flat amount or can range from 1% to 3% of the loan amount and can increase the cost of your loan considerably.

Furthermore, it is prudent to foreclose your loans to save the interest payment on future EMIs whenever you have adequate funds. You should know that most banks and financial institutions charge pre-payment fees if you want to foreclose your Personal Loan. The charges vary from company to company and generally range between 2% to 5%, which makes a big difference, especially when the dues are high.

Therefore, it is advisable to consider all the fees and charges and calculate the total cost of the loan before finalising the lender.

Image source: www.freepik.com

Image source: www.freepik.com

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

3. Loan Amount:

Lenders have limits on the minimum and maximum personal loan amount they can offer to a single borrower. Hence, before approaching a lender, you should clearly know why you need the funds and how much is the exact amount you need because, depending on your financial needs, the lender should be able to offer sufficient funds at an affordable rate of interest. The loan amount may also vary depending upon your eligibility and credit profile. Therefore, it makes sense to compare different lenders on the parameter of the loan amount they offer you and choose the one who can offer a sufficient loan amount at an affordable rate of interest.

4. Processing Time:

As discussed above, nowadays, banks and NBFCs offer different types of Personal Loans. Instant personal loans and Pre-approved Personal Loans can be availed quickly compared to Regular Personal Loans, as these loans are typically offered to existing customers with good credit records. If you urgently require funds, it is advisable to check with your existing lender or primary bank, who can offer you a Personal Loan instantly at an attractive rate of interest. Some instant loans can be availed in a matter of a few minutes to 48 hours. Whereas Regular Personal Loans can take up to 7 to 15 days, depending upon the lender's policy and your credit profile.

5. Customer Service:

While taking a loan is a one-time experience, you will need the assistance of your lender in several situations. Many borrowers do not consider it when choosing a lender, but if the lender's customer service is not satisfactory, you can get disappointed in the future. Therefore, it is essential to choose a lender wisely that offers good customer reviews. You can check the actual customer reviews online and make your decision.

To conclude:

When it comes to availing of a Personal Loan, there are a plethora of options as almost all the banks and NBFCs offer Personal Loans. However, in order to get the maximum benefits, make sure you compare different lenders on different parameters explained above. A Personal Loan is the best choice in case of an emergency, particularly when you do not have any other financial support and need funds urgently. Sadly, people often apply for Personal Loans for instant gratification and put themselves under stress, paying hefty EMIs. So, if you want to buy that gadget, jewellery, or luxury item that can easily be postponed, think again and do not take a Personal Loan.

Warm Regards,

Ketki Jadhav

Content Writer