HDFC Nifty 100 Equal Weight Index Fund: Is it a Valuable Investment Proposition?

Mitali Dhoke

Feb 15, 2022

Listen to HDFC Nifty 100 Equal Weight Index Fund: Is it a Valuable Investment Proposition?

00:00

00:00

Passive investing has picked up a significant pace in the market. In these prevailing volatile market conditions, the strategy of tracking a specific index that measures the performance of market capitalizations across sectors under one roof has drawn investors' interest.

Investors looking for balanced diversification and anti-momentum approaches to play equity index funds could consider buying units of equal weight index funds tracking the Nifty 50 and Nifty 100 for their core equity portfolio. Smart beta products based on equal weight indices provide an anti-momentum, forced buy-low-sell-high investment strategy that reduces stock and sector concentration risks.

Investors seeking to build wealth over the long run without exposing their portfolios to excessive risk and volatility can consider passive investing in the Nifty 100 Equal Weight index. It includes the same high-quality equities as the blue-chip baskets but with the added benefit of equal weightage for all constituents. HDFC Mutual Fund has launched HDFC Nifty 100 Equal Weight Index Fund; it is an open-ended scheme replicating/tracking the NIFTY 100 Equal Weight Index.

On the launch of this fund, Mr Navneet Munot, MD & CEO at HDFC AMC, said, "Launch of this NFO is a part of our endeavour to expand our product bouquet in HDFC MF Index Solutions and allow customers easy access to India's 100 largest companies. HDFC AMC has been one of the oldest players in index solutions with proven capability."

Table 1: Details of HDFC Nifty 100 Equal Weight Index Fund

| Type |

An open-ended scheme replicating/tracking NIFTY 100 Equal Weight Index (TRI) |

Category |

Index Fund |

| Investment Objective |

To generate returns that are commensurate (before fees and expenses) with the performance of the NIFTY 100 Equal Weight Index TRI (Underlying Index), subject to tracking error. There is no assurance that the investment objective of the Scheme will be realized. |

| Min. Investment |

Rs 5,000 and in multiples of Re 1/- thereafter. Additional Purchase Rs 1,000/- and in multiples of Re. 1 thereafter. |

Face Value |

Rs 10/- per unit |

| SIP/SWP/STP |

Available |

|

|

| Plans |

|

Options |

|

| Entry Load |

Not Applicable |

Exit Load |

Nil |

| Fund Manager |

Mr.Krishan Kumar Daga |

Benchmark Index |

NIFTY 100 Equal Weight Total Returns Index (TRI) |

| Issue Opens |

February 11, 2022 |

Issue Closes |

February 18, 2022 |

(Source: Scheme Information Document)

The investment strategy for HDFC Nifty 100 Equal Weight Index Fund will be as follows:

HDFC NIFTY 100 Equal Weight Index Fund will be managed passively with investments in stocks comprising the Nifty 100 Equal Weight Index, subject to tracking error. The underlying index employs a simple, smart beta strategy that tends to outperform when broader markets outperform.

Secondly, the investment strategy would revolve around reducing the tracking error to the least possible through regular rebalancing of the portfolio, taking into account the change in weights of stocks in the Index as well as the incremental collections/redemptions in the Scheme.

(Image Source: www.freepik.com)

(Image Source: www.freepik.com)

Since the scheme is an index fund, it will only invest in securities constituting the Underlying Index. However, due to corporate action in companies comprising the index, the Scheme may be allocated/allotted securities which are not part of the index. Such holdings would be rebalanced within 7 Business Days from the date of allotment/listing of such securities.

As part of the Fund Management process, the Scheme may use derivative instruments such as index futures and options, or any other derivative instruments that are permissible or may be permissible in the future under applicable regulations. However, trading in derivatives by the Scheme shall be for restricted purposes as permitted by the regulations. Subject to the Regulations and the applicable guidelines, the scheme may engage in Stock Lending activities. A part of the funds may be invested in debt and money market instruments to meet the liquidity requirements.

Under normal circumstances, the Asset Allocation will be as under:

Table 2: Asset Allocation for HDFC Nifty 100 Equal Weight Index Fund

| Instruments |

Indicative Allocation (% of net assets) |

Risk Profile |

| Minimum |

Maximum |

High/Medium/Low |

| Securities covered by NIFTY 100 Equal Weight Index# |

95 |

100 |

High |

| Debt Securities & Money Market Instruments, units of Debt Schemes of Mutual Funds |

0 |

5 |

Low to Medium |

#Includes shares of HDFC Asset Management Company Limited. It may be noted that the NIFTY 100 Equal Weight index has been constructed and managed by NSE Indices Limited (formerly known as India Index Services & Products Limited - IISL), a subsidiary of National Stock Exchange of India Limited (NSE). The HDFC NIFTY 100 Equal Weight Index Fund will be managed passively to replicate the performance of the Underlying Index.

*The above limits shall not apply to Subscription and Redemption Cash Flow. Subscription cash flow is the subscription money received for deployment and redemption cash flow is the money kept aside for meeting redemptions.

(Source: Scheme Information Document)

About the benchmark

The NIFTY100 Equal Weight Index comprises of same constituents as NIFTY 100 Index (free float market capitalization based Index. The NIFTY 100 tracks the behaviour of a combined portfolio of two indices viz. NIFTY 50 and NIFTY Next 50.

-

Each constituent in NIFTY100 Equal Weight Index is allocated fixed equal weight at each re-balancing.

-

Securities will be excluded if rank based on full market capitalisation falls below 110 or if constituents get excluded from NIFTY 500.

The Index being a version of NIFTY 100, the selection criteria remain the same as the NIFTY 100 Index would comprise of the securities which are constituents of NIFTY 50 and NIFTY Next 50. Any changes i.e., inclusion and exclusion of securities in NIFTY 50 and NIFTY Next 50, would be automatically mirrored in this index.

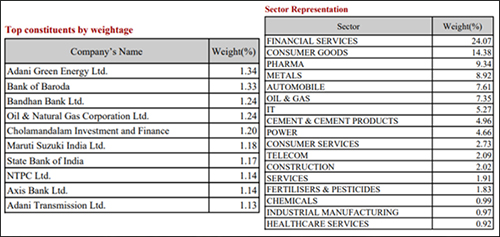

Here's the list of top 10 constituents by weightage and sector representation of the index as on January 31, 2022:

(Source: Nifty 100 Equal Weight Index Factsheet as of January 31, 2022)

(Source: Nifty 100 Equal Weight Index Factsheet as of January 31, 2022)

Note that the index does a rebalancing on a semi-annual basis in January and July every year.

Who will manage HDFC Nifty 100 Index Fund?

Mr Krishan Kumar Daga is the designated fund manager for this scheme. He is a B. Com graduate and has over 24 years of experience in Fund Management and Research. Prior to joining HDFC AMC, he was associated with Reliance Capital Asset Management Company Ltd. as Fund Manager / Head - ETF, Reliance Capital Ltd. as Vice President, and Deutsche Equities as Vice President.

At HDFC AMC, Mr Daga currently manages HDFC Arbitrage Fund, HDFC Banking ETF, HDFC Equity Savings Fund (Arbitrage Assets), HDFC Gold ETF, HDFC Gold Fund (FOF), HDFC Index Fund - NIFTY 50 Plan, HDFC Index Fund - SENSEX Plan, HDFC Multi-Asset Fund (Gold related instruments and Arbitrage Assets), HDFC NIFTY 50 ETF, HDFC SENSEX ETF, HDFC NIFTY50 Equal Weight Index Fund, HDFC Developed World Indexes Fund of Funds and HDFC NIFTY Next 50 Index Fund.

Fund Outlook - HDFC Nifty 100 Equal Weight Index Fund

HDFC Nifty 100 Equal Weight Index Fund aims to mirror the performance of the Nifty 100 Equal Weight Index. The underlying index represents the 100 largest companies spread across major sectors of the economy. The fortune of this scheme will be closely linked to how the Nifty 100 Equal Weight Index performs.

The underlying index provides a complete representation of the Indian Large Cap universe, though the Nifty 100 and Nifty 100 Equal Weight index consists of the same companies, there is a difference in their weightage. The equal-weight index strategy simply allocates equal weight to all stocks instead of considering market capitalisation as the sole criteria for asset allocation.

The scheme offers a relatively stable equity allocation via a Large-cap index that can be beneficial to maintain stability in an investor's portfolio. Being an Index fund, it will follow a passive investing approach and reduce the risk of stock selection by the fund manager.

However, that does not take away the high market risk due to the threat of the Omicron variant and the US Federal Reserve's announcement of a reduction in stimulus. In addition, the monetary policy action and stance amidst the inflationary pressures taken by the RBI may pose a risk to economic growth. The margin of safety appears to be narrow, and the clear direction for the equity market from the current elevated levels is unknown. These, among many other factors, may affect the scheme's performance, and the portfolio may face intensified volatility in the near term.

Thus, you may consider investing in HDFC Nifty 100 Equal Weight Index Fund only after it has built a reliable track record. Ensure you hold a high-risk appetite, a long investment horizon to sustain market volatility, and an investment objective that aligns with the fund.

PS: If you wish to select actively managed worthy mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

As a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

PersonalFN recommendations go through our stringent process that assesses both quantitative and qualitative parameters, providing you with Buy, Hold, and Sell recommendations on equity and debt mutual fund schemes. Read here for more details...

If you are serious about investing in rewarding mutual fund schemes, Subscribe now!

Warm Regards,

Mitali Dhoke

Jr. Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds