Is It Time to Sell Underperforming Equity Mutual Fund Schemes in the Portfolio?

Listen to Is It Time to Sell Underperforming Equity Mutual Fund Schemes in the Portfolio?

00:00

00:00

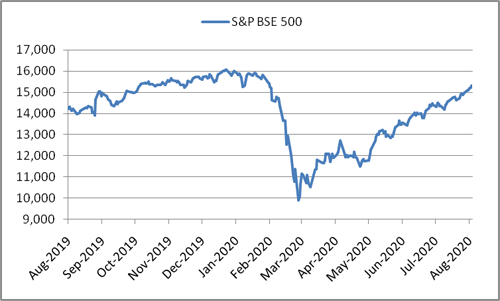

Investors who have been disappointed with their mutual fund returns over the past few months and decided to continue holding on to their investment nonetheless have a reason to cheer. The broader index - S&P BSE 500 has rebounded close to 55% from its lows of March. With this, the long-term returns of equity mutual fund have improved too.

However, certain equity funds that are still performing poorly as compared to the benchmark and category peers.

Do you hold any such schemes?

If yes, here is what you should do...

Firstly, make sure that you are not judging the schemes solely based on the recent performance. The point here is that no fund can top performance charts year after year. A fund may be a top performer in one year and among the bottom performers the next year. But that does not make it a bad fund. The opposite holds true as well.

[Read: Should You Shift from Mutual Funds to Invest Directly in Stocks?]

Graph: S&P BSE 500 recovered close to 55% from its lows of March

Data as on August 28, 2020

(Source: ACE MF)

Mutual funds managers invest in a diversified portfolio of stocks and sectors. The performance of each stock/sector depends on various micro and macro-economic factors. Over a period of time, growth may be conducive for select stocks/sectors and/or strategies, but not for others; though it is likely to play out eventually.

For e.g., value stocks have fallen out of favour in the last couple of years when the market became overvalued; therefore, valued fund as a category underperformed significantly. The recent crash, however, provided a great value-buying opportunity, which can help the value fund category regain the investors' attention.

Investors can ignore short-term underperformance due to market function, but if the scheme has been consistently underperforming the benchmark and its category peers over various time-periods, then you certainly need to track it closely.

[Read: Should You Stop Investing in Equity Mutual Funds Generating Returns Lower Than a Bank FD?]

Apart from returns, there are other quantitative and qualitative parameters that determine whether the fund is worth holding on to. If the fund lacks in more than one of these parameters, it may fail to generate meaningful returns. Here is how you can evaluate if the lag in the performance of the scheme is due to short-term market fluctuation or whether it is consistently underperforming...

-

Check returns over longer time horizon such as 3-year, 5-year, etc.

-

Assess risk-reward ratios such as standard deviation, Sharpe, Sortino, etc. to find out if investors are being rewarded for the risks they undertake.

-

Compare the performance of the scheme relative to its benchmark and category peers across different market phases and cycles. The scheme should be able to contain the downside risk during tough market conditions and outperform the market during an upward market trend.

-

Pay attention to portfolio characteristics of the fund as the fortune of a mutual fund scheme is closely linked to the portfolio it holds. If the portfolio characteristics of the scheme are not up to the mark, it could show up in inconsistent returns.

-

Evaluate the efficiency of the fund manager and the systems and processes that are followed at the fund house as they are directly responsible for the performance of scheme.

If based on the above-mentioned parameters you conclude that your fund is consistently underperforming, then it may prudent to replace it with a better alternative.

(Image source: photo created by freepik -www.freepik.com)

The decision to sell the scheme should be taken based on a rational and unbiased approach with thorough research and analysis.

[Read: Do You Own Equity Mutual Funds That Have Underperformed Their Benchmark? Read This!]

Apart from the consistent underperformance of the scheme, listed below are the other circumstances when one can consider exiting their equity mutual fund scheme:

-

Your investment has grown to the desired corpus

-

To gradually shift to safer avenues when your financial goal is approaching

-

During portfolio rebalancing to maintain the desired asset allocation

-

The fund objective changes and is no longer in congruence with your own objective

-

The fund risk profile changes and doesn't match your current risk appetite

-

In case of a financial emergency when you have no other option

-

You wish to adopt change in investment style (value, growth, blend, aggressive, conservative, etc.)

Though the markets have recovered substantially from its lows, further bouts of volatility and short-term underperformance cannot be ruled out. Therefore, to ensure that your investment can efficiently tide over the market uncertainty and volatility, invest in a strategic portfolio of mutual funds based on the 'Core & Satellite' approach to investing.

The 'Core' holding should comprise around 65-70% of your equity mutual fund portfolio and consist of large-cap fund, multi-cap fund, and a value style fund. Whereas, the 'Satellite' holdings of the portfolio can be around 30-35% comprising of a mid-cap fund, a large & mid-cap fund, and an aggressive hybrid fund.

Additionally, to hedge your portfolio from adverse conditions such as the one we are witnessing now, allocate around 10% of your investment portfolio in gold, preferably through a Gold ETF or a Gold savings fund.

The 'Core & Satellite' approach aids in diversification across categories and investment styles, thereby reducing the risk to your portfolio. It can provide a cushioning during the downside in a bear phase and outperform during a bull phase. If your portfolio is strategically placed, there will be no need for constant churning of the portfolio and you will be well placed to tide over the market volatility.

If you wish to invest in a readymade portfolio of top recommended equity mutual funds based on the 'Core & Satellite' approach to investing, I recommend that you subscribe to PersonalFN's Premium Report, "The Strategic Funds Portfolio For 2025 (2020 Edition)". This premium report will help you build your optimum mutual funds portfolio for 2025 without any effort on your part. If you haven't subscribed yet, do it now!

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds