Special Care to Take While Investing in Equity Mutual Funds at a Market High

Listen to Special Care to Take While Investing in Equity Mutual Funds at a Market High

00:00

00:00

Market bellwether S&P BSE Sensex and Nifty 50 indices closed at fresh all-time high last Friday, i.e. August 13, 2021. The Sensex and Nifty 50 index zoomed past the 55,000 and 16,500 mark, respectively, for the first time. Though the mid-cap and small-cap indices witnessed some consolidation in the last few days, it continues to trade at high levels.

Improvement in economic activities, pickup in vaccination drive against COVID-19, robust corporate earnings, and accommodative stance from the RBI are some of the factors that boosted investor sentiment. Notably, it is the domestic retail investors that are currently driving the market as foreign investors turned net sellers in July.

Now the question that arises here is -

Whether you should continue to stay invested in equity mutual funds during market highs in anticipation of further gains?

or

Book profits as the traditional wisdom advises buying low and selling high?

The answer depends on your financial goals, risk profile, investment horizon, etc. For someone who has a long term investment horizon (5 years or more) short term market movement should not be a cause of concern. Investing in equity mutual funds for the long term helps you to make the most of power of compounding and enables your wealth to grow optimally.

(Image source: our-team - www.freepik.com)

If you are planning to invest in equity mutual funds during market highs, then here are the special care you must take:

1) Invest in quality mutual funds

Amid the sharp rally in the equity market, the valuations across market cap are now in the expensive zone. Therefore, the margin of safety has narrowed. In such a situation, it is important to not get swayed by the short term performance of a scheme. Choose mutual fund schemes carefully by looking at its long term performance. Prefer to invest in mutual fund schemes that perform well across bull and bear market phases.

Ensure that the scheme invests in a well-diversified portfolio of quality stocks instead of chasing momentum bets. Additionally, it is important to lay emphasis on the equity funds that have the ability to generate decent premium for the level of risk you have taken. You can pick them by assessing ratios such as Sortino Ratio, Sharpe ratio, Standard Deviation, etc.

2) Stick to your asset allocation plan

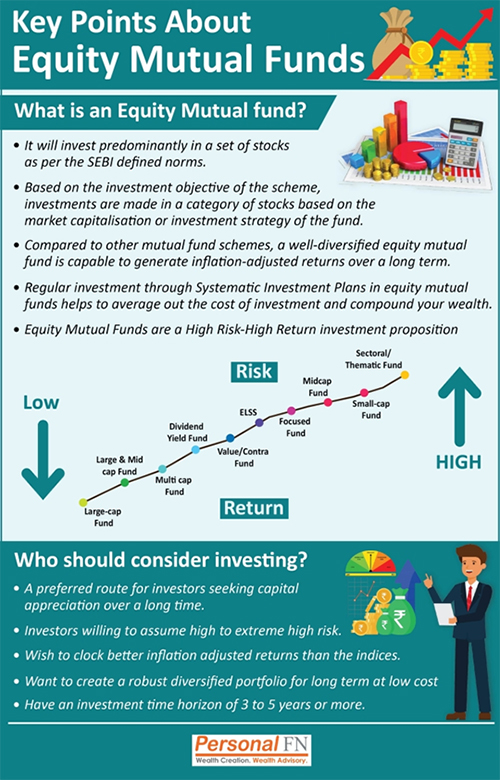

During market highs you may be tempted to invest in high return avenues such as mid-cap funds, small-cap funds, thematic/sector funds, etc. However, it is important to note that these categories entail high risk. If the market turns volatile these categories could witness a significant drawdown.

To get the most of your mutual fund investment, diversify across various categories and sub-categories depending on your risk profile, financial goals, and time horizon. Stick to your asset allocation plan regardless of the market condition. Consider rebalancing whenever any of the asset class in the portfolio witnesses a deviation of say +/- 5% from its set allocation. For instance, if the equity allocation has risen significantly in your portfolio, then you should consider booking profits and shift it to other less risky asset class.

3) Do not add too many schemes to your portfolio

While diversification is the basic tenet of investing, over-diversification is counter-productive to wealth creation. It is easy to be lured by new fund offers that are usually launched when the markets are at high levels. Adding too many mutual fund schemes does not add value to your overall portfolio, neither does it help in lowering the market risk. Moreover, it makes reviewing the performance of the portfolio a daunting task.

Most individual investors require not more than 5-10 mutual fund schemes, depending on the size of the portfolio. These would include schemes across equity mutual funds, debt mutual funds, hybrid mutual funds, and ELSS funds. Add a new scheme to your portfolio only if it can aid in diversification and aligns with your investment objective.

4) Avoid timing the market

Timing the market can lead to missed opportunities and you may end up earning returns lower than the market. It is a common belief among many investors that by moving in and out of funds based on market movement, they can maximise the returns. But in reality it harms your returns leading to a gap between what investors earn and what the fund earns. Further, it can increase the cost of investment.

Remember that market ups and downs are an eternal part of equity investment. Investors who stay invested for the long term regardless of the market conditions are more likely to earn higher returns. Instead of trying to time the market, opt for the SIP route to invest in a disciplined manner and efficiently employ rupee-cost averaging.

5) Review periodically

Due to the sharp rally in the market most equity mutual funds have generated good returns in the last 1 year. Despite this, if your mutual fund has underperformed its peers and the benchmark index conduct a review of your portfolio. Remember that no mutual fund scheme can turn out to be an outperformer year after year. Therefore, short term underperformance of a scheme should not be a concern. This is because some bets/strategies of the fund manager may not payoff in the short term due to dynamic market conditions. But over the long term, it can reward you with handsome gains.

However, if a scheme has been consistently underperforming the benchmark and its category peers over various time-periods, then you certainly need to track it closely. Reviewing the portfolio will help you to weed out such underperformers thereby improving the risk-adjusted returns.

Summing up

The equity market has more than doubled since the lows of March 2020. However, going ahead bouts of volatility cannot be ruled out. If you are looking to create an all-weather mutual fund portfolio that can efficiently tide over the market uncertainty and volatility, invest in a strategically designed portfolio of mutual funds based on the 'Core & Satellite' approach to investing.

If you wish to invest in a readymade portfolio of top recommended equity mutual funds based on the 'Core & Satellite' approach to investing, I recommend that you subscribe to PersonalFN's Premium Report, "The Strategic Funds Portfolio For 2025 (2021 Edition)". This premium report will help you build your optimum mutual funds portfolio for 2025 without any effort on your part. If you haven't subscribed yet, do it now!

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds